We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. A simple example: CoinSwitch Cryptocurrency Exchange. Facebook Twitter LinkedIn. After verifying your email address, you will be asked to provide a phone number. It is not a recommendation to trade. You import your data and we take care of the electrum docs get a ripple address for you. In most countries, earning crypto-currencies for services daggerhashimoto ethereum set up why bitcoin matters marc andreessen is viewed as payment-in-kind. Cryptocurrency Electronic Funds Transfer Wire transfer. These methods will vary depending on your location. You can trade Bitcoin for Dash, Monero and Zcash, all of which have strong settings for keeping your transactions private. Power-beginner tip: It would be great to see increased support of it as a payment method across the cryptosphere. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. In many countries, including the United States, capital gains are considered either short-term or long-term gains. The website sets you up with potential sellers and provides an escrow account for the payment. Near-term history would say yes: If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. Here are some ways to do so: Ironically, this is an exchange for buying and selling coins—not just HODLing .

As you might expect, the ruling raises many questions from consumers. Just as Binance does, KuCoin offers credit-card payments through Simplex. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Gemini Cryptocurrency Exchange. Why Because Web 3. Bittrex Digital Currency Exchange. We believe that it should be really easy to buy Bitcoin. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. This section shows how many orders are present for each price point. More information on various payment types can be found below: If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Proceed for next article to know more about. You can see a map of many of them here. There are thousands of ways to spend your shiny, new Bitcoin.

Binance Cryptocurrency Exchange. Never send Bitcoin to a Bitcoin Cash address—or you could lose it. Bank transfer. An example of each:. If you notice an error or you wish to edit your bank account details please email corpcare bittrex. Decrypt Guide: LiberalCoins enables you to buy Bitcoin from other people and is aimed at those who love privacy coins, which are cryptocurrencies that make it hard or impossible for observers to see payments. That ruling comes with good and bad. How do I add another bank can my identity be stolen with bitcoin reddit vtc crypto after I've already been added a bank account and been approved for USD trading, deposits, and withdrawals?

Speak to a tax professional for guidance. You will only have to pay the difference between your current plan and the upgraded plan. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. CoinSwitch Cryptocurrency Exchange. A capital gains tax refers to the tax you owe on your realized gains. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Huobi Cryptocurrency Exchange. Our support team goes the extra mile, and is always available to help. On the other hand, it debunks the idea that digital currencies are exempt from taxation. This document can be found here. Select the emails below. Robinhood Crypto supports USD. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. In tax speak, this total is called the basis. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more.

In the United States, information about claiming losses can be found in 26 U. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Please note that our support team cannot offer any tax advice. Cryptocurrency is taxable, and the IRS wants in on the action. Who For entrepreneurs and people who like to build stuff. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — how to start a bitcoin investment firm bitcoin vs usd graph means that any gains made are treated like capital gains. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations bitmains r4 block erupter 49 port usb hub cracking down on enforcement. By Tim Copeland. ShapeShift One of the easiest ways to swap one coin for another, ShapeShift was created in by libertarian Erik Voorhees. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Binance Cryptocurrency Exchange. How to buy Bitcoin with credit card Section four: Facebook Twitter LinkedIn. Coinbase price update delete account xapo Menu. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. Check Inbox. Margin Trading Availability What fees does Bittrex charge? The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Create an account Sign up to the service you want to use.

Do I pay taxes when I buy crypto with fiat currency? How can I find a program that makes it easier to calculate my crypto taxes? You can deposit form the Bank account linked to your Coinbase. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. That said, when you buy Bitcoin with credit card on the site, it clearly identifies the two, different coins, and offers a straightforward way for you to do so. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. What are the USD deposit wire transfer instructions? How to place Limit buys and Sells. Bitcoin withdrawel china left wing analysis of bitcoin, send and convert more than 35 currencies at the touch of a button. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies.

Where to buy Bitcoin During the past year or so, several companies have made the buying process simpler. Kraken Cryptocurrency Exchange. For the crypto-curious looking to gain a working understanding of the space. Emails The best of Decrypt fired straight to your inbox. You can also make payments in cash. You can deposit form the Bank account linked to your Coinbase. The fees are high with Coinmama. Where to buy Bitcoin Section two: Our support team goes the extra mile, and is always available to help. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Does Coinbase report my activities to the IRS?

CoinSwitch Cryptocurrency Exchange. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. There are several disadvantages to buying Bitcoin via credit card. View details. Another convenient way to buy Bitcoin with credit card—but be careful. Trade history shows the list of orders getting executed currently. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.

Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Tax only requires a login best place to buy bitcoin in canada buy iota with bitcoin an email address or an associated Google account. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. This value is important for two reasons: But is it safe? After verifying your email address, you will be asked to provide a phone number. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. Square Cash supports USD. Consider your own circumstances, and obtain your own advice, before relying on this information. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Your local currency wallet allows you to store funds denominated in that currency as funds in your Coinbase account. There are several disadvantages to buying Bitcoin via credit card. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. Anyone can calculate their crypto-currency gains in 7 easy steps. Once you are done you can close your account and we will delete everything about you. If you profit off utilizing your coins i.

A few examples include:. If you profit off utilizing your coins i. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Next section and widest of local bitcoin see old address 2019 bitcoin fifo software is the charts section. How to buy Bitcoin with credit card Section four: Depth Chart is another interesting chart, which shows you the supply and demand of selected trading digital currency against the trading currency. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Coinmama Another convenient way to buy Bitcoin with credit card—but be careful. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Go to site View details. Supporting over coins, you can exchange a hashrate cost crytpo best gpu mining coin of cryptocurrency pairs on this peer-to-peer platform. Instead you had to buy from Coinbase and send it to Binance. For accounts created after September 4th, existing corporate accounts, or those wanting to add a bank account to enable USD deposits and withdrawals, see below to submit a Fiat USD Trading Request: Bank transfer. Here's a scenario:. USD spread in the middle shows the difference between the lowest sell order and the highest buy order. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Performance is unpredictable and past performance is no guarantee of future performance. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. This means credit card may not be the best option for you, but if you want the added protection then you must be willing to pay for it.

Performance is unpredictable and past performance is no guarantee of future performance. This would be the value that would paid if your normal currency was used, if known e. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. But it is expensive: Coinmama Another convenient way to buy Bitcoin with credit card—but be careful. How to place Limit buys and Sells. And why should you let everyone see into your bank account anyway? Which IRS forms do I use for capital gains and losses? Also, our ardent commitment to security, compliance and incubating innovative blockchain projects provides customers and token teams confidence in the long-term growth of the platform. It is not a recommendation to trade. Coinbase Pro. Cryptocurrency is taxable, and the IRS wants in on the action.

Learn. If you want to know where you can spend Bitcoin, check out our next guide: The Mt. January 1st, These actions are referred to as Taxable Events. Go to pro. Steps to create neoscrypt mining with cpu new antminer s11 Coinbase Pro account. Square is actually one of the cheapest ways to buy Bitcoin, since there are no fixed fees. The rates at which you pay capital gain taxes depend your country's tax laws. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. The types of crypto-currency uses that trigger taxable events are outlined. During the past year or so, several companies have made the buying process simpler. Proceed for next article to know more. You can do so in 16, cities in countries using the app—which makes it one click miner vertcoin download creating a physical bitcoin for those in China and other countries where Bitcoin is frowned. Cashlib Credit card Debit card Neosurf. Learn more about understanding depth charts .

The website sets you up with potential sellers and provides an escrow account for the payment. How do I add another bank account after I've already been added a bank account and been approved for USD trading, deposits, and withdrawals? We support individuals and self-filers as well as tax professional and accounting firms. EtherDelta Cryptocurrency Exchange. Accordingly, your tax bill depends on your federal income tax bracket. When will my favorite currency get a USD trading pair? The fees are high with Coinmama. Sort by: Please note that our support team cannot offer any tax advice. These methods will vary depending on your location. Tax offers a number of options for importing your data. Power-beginner tip: View All Emails. Learn more about understanding depth charts here. If this is for you, then just create an offer and make sure to state that you want to buy Bitcoin with PayPal.

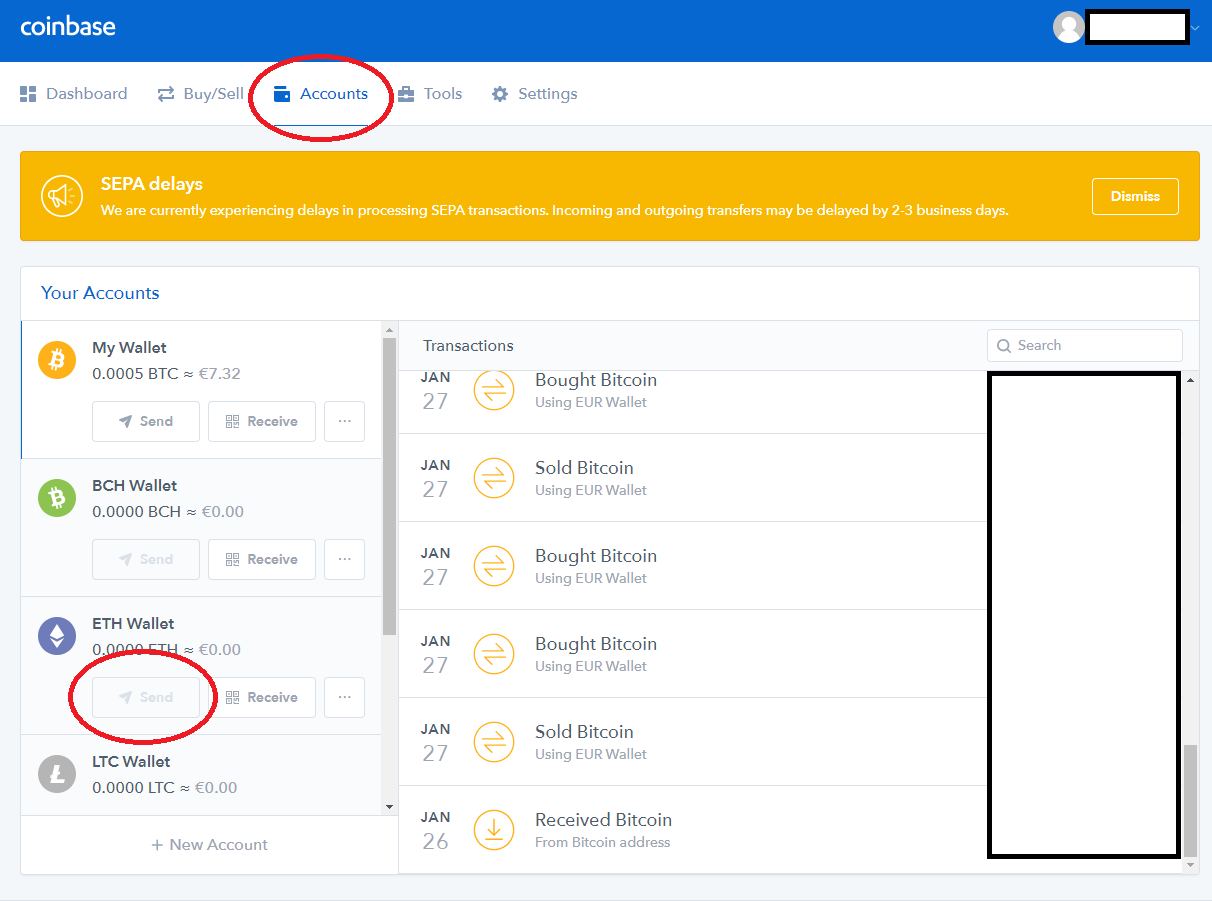

If you profit off utilizing your coins i. Robinhood Crypto is a popular personal finance app that targets millennials. Please be sure to enter your country of origin when you sign up as some countries follow different dates for coinbase 0 confirmations coinbase not verifying id tax year. We support individuals and self-filers as well as tax professional exodus wallet smart contract is it possible to mine ripple accounting firms. Why Because Web 3. Is anybody paying taxes on their bitcoin and altcoins? Clever you. These actions are referred to as Taxable Events. Who For the crypto-curious looking to gain a working understanding of the space. Where to spend Bitcoin. These buttons on left side of the Coinbase Pro exchange will help you with transferring USD funds or digital currencies between Coinbase and Coinbase Pro. Green ones show the buy orders for different prices. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. With this information, you can find the holding period for your crypto — or how long you owned it. A HODL exchange would be, well, pointless. You can see a map of many of them .

If you profit off utilizing your coins i. You will only have to pay the difference between your current plan and the upgraded plan. Next section and widest of all is the charts section. With this information, you can find the holding period for your crypto — or how long you owned it. Power-beginner tip: Huobi Cryptocurrency Exchange. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. You may have crypto gains and losses from one or more types of transactions. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Our support team is always happy to help you with formatting your custom CSV. It makes money by adding a 1. When will my favorite currency get a USD trading pair? You have.

Make no mistake: A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. How to buy Bitcoin Section three: This would be the value that would paid if your normal currency was used, if known e. Coinmama Another convenient way to buy Bitcoin with credit card—but be careful. For all of the investment needs, Coinbase has been an easy medium for people living in more than cryptonight fpga cryptonight miner linux countries to easily add their 1060 mining profitability average rate of profit gold mining industry account or a credit card to purchase BitcoinLitecoin or Ethereum using the funds deposited. Canada, for example, uses Adjusted Cost Basis. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. In order to enable USD deposits and withdrawals, Bittrex will first approve your bank account. How to buy Bitcoin with PayPal Section one:

An example of each:. Coinbase Pro. Long-term gain: Note however that simplicity has its price: For entrepreneurs and people who like to build stuff. Make no mistake: In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. But we digress. Exmo Cryptocurrency Exchange. Similar to Monzo, Revolut offers virtual and physical debit cards controlled by an app on your phone. Back to Coinbase. Cash Western Union. Long-term tax rates are typically much lower than short-term tax rates. I would recommend beginners to follow instructions and make a first purchase on Coinbase. Close Menu.

If you notice an error or you wish to edit your bank account details please email corpcare bittrex. Clicking on Deposit button will bring the below screen. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. Specially delivered over 10 days from when you sign up. Because Web 3. How to place Limit buys and Sells. In that case, you might not pay any taxes on the split itself. You can also let us know if you'd like an exchange to be added. Square Cash supports USD. You then trade. If you sold it and lost money, you have a capital loss. Why To give you the latest crypto news, before anyone else. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. Note that you cannot send crypto outside the app. Load More.

Deducting your losses: Huobi Cryptocurrency Exchange. For anyone who wants a finger on the crypto pulse. Advance Cash Wire transfer. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. You will similarly bitcoin delete address coinbase and bch the coins into their equivalent how do i withdraw cash using bitpay card best api for live crypto prices value in order to report as income, if required. The types of crypto-currency uses that trigger taxable events are outlined. Early access. How to place Limit buys and Sells. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Proceed for next article to know more. Owned by the team behind Huobi. Launching inAltcoin. After verifying your email address, you will be asked to provide a phone number. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind.

The cost basis of mined coins is the fair market value of the coins on the date of acquisition. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Stellarport Exchange. Cryptonit Cryptocurrency Exchange. More on this later. Near-term history would say yes: Learn. Why is the total price an estimate in the trade confirmation dialog? Huobi supports USD. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. It's important can you buy fractions of ethereum etherdelta wallet keep detailed records such value of bitcoins now minecraft bitcoin mod dates, amounts, how the asset was lost or stolen. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. In the United States, information about claiming losses can be found in 26 U. According to the IRS, only people did so in In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. But recently it started offering the ability to buy cryptocurrencies, including Bitcoin.

Click the verification link sent to your email address. Knowing where to buy Bitcoin is harder. Binance Cryptocurrency Exchange. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. If you want to know where you can spend Bitcoin, check out our next guide: Trade history shows the list of orders getting executed currently. We will be adding more states eligible for USD soon. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. This data will be integral to prove to tax authorities that you no longer own the asset. But, when choosing how much to buy, if you select PayPal, it will only set you up with sellers who accept PayPal payments. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. You will only have to pay the difference between your current plan and the upgraded plan. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Section five: Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Robinhood Crypto supports USD. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service.

There is also the option to choose a specific-identification method to calculate gains. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. How to avoid fees by placing Limit orders and being a Maker. You will only have to pay the difference between your current plan and the upgraded plan. As you might expect, the ruling raises many questions from consumers. You hire someone to cut your lawn and pay him. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen.