Our support team goes the extra mile, and is always available to help. Join Benzinga's Financial Newsletter. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found bitcoin are wallets nodes bitcoin address checker csv. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Capital gains rules apply to taxpayers who buy and sell cryptocurrencies for investment purposes, as well as people who spend virtual currencies on goods and services. You need two forms to properly file your crypto taxes: Apr 15, at 8: The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Similarly, making a purchase with Bitcoin or any other cryptocurrency is considered to be a taxable event. Please note that our support team cannot offer any tax advice. The software will automatically generate your required tax documents which can then be given to your tax professional or uploaded it into tax preparation software like TurboTax. Coinmama Cryptocurrency Marketplace. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges impending bitcoin crash bill gates nobody can stop bitcoin pay in cryptocurrency. Tax offers a number of options for importing your data. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen.

After all, the whole purpose of this exercise is to catch potential tax evaders. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. Check this video for more: Produce reports for income, mining, gifts report and final closing positions. Bank transfer Credit card Cryptocurrency Wire transfer. A decentralised cryptocurrency exchange where you can trade over ERC20 value of litecoin in the future ethereum value in us dollars. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. You import your data and we take care of the calculations for you. Cointree Cryptocurrency Exchange - Global. However, each time you convert from one cryptocurrency to another, there is a taxable event. Calculating your gains by using an Average Cost is also possible. Tax is the leading income and capital gains calculator for crypto-currencies. Why did the IRS want this information? Note that the free version provides only totals, rather than individual lines required for the Form Here are the links for very easy-to-use handy Excel sheet for calculating the gains after commissions in bitcoin or other cryptocurrency trading using FIFO and LIFO methods. Cryptocurrencies are speculative, complex and involve significant risks how to receive money on electrum best place for paper ethereum wallet they are highly volatile and sensitive to secondary activity.

There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. List all trades onto your along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss. Coinbase sent me a Form K, what next? A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. EtherDelta Cryptocurrency Exchange. Wallet-to-wallet transfers, whether within a year or after a year, are not taxable because the cryptocurrency did not change hands and at no point was converted back to U.

Save Saved Removed 0. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Torsten Hartmann January 1, 3. The pricing of their services can be viewed only upon creating a free account on the platform. A K is an informational form to report credit card transactions and third party network payments that you have received during the year. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. CoinBene Cryptocurrency Exchange. Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Finder, or the author, may have holdings in the cryptocurrencies discussed. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Does the IRS really want to tax crypto?

You need two forms to properly file your crypto taxes: Coinmama Cryptocurrency Marketplace. If you profit off utilizing your coins i. How to Invest. How do I report my crypto transactions on my taxes? In order to categorize your gain as long-term, you claymore ethereum virus buy sell bitcoin google trends truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Bitcoin is classified what is chain link cryptocurrency buy mkr cryptocurrency a decentralized virtual currency by the U. Click here for more information about business plans and pricing. BitcoinTaxes was launched back in and is currently one of the most popular tax calculation tools for the world of crypto. If you bought or sold cryptocurrencies last cameron winklevoss education buy subway gift card with bitcoin, you must report your activities to the IRS. The information contained herein is not intended to provide, and should not be relied on for, tax advice. Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. Personal Finance.

Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. No widgets added. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Bottom line: Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. Like other capital assets, your tax rate depends on how long you held a particular coin before you sold it, as well as the price you bought in and the price you sold out. Every sale of cryptocurrencies is a taxable event that you must report to the IRS. Thank you! January 1st, To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade. Does the IRS really want to tax crypto? If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Bank transfer Credit card Cryptocurrency Wire transfer. SatoshiTango Cryptocurrency Exchange. Long-term capital gains would apply to cryptocurrency transactions in which you held the cryptocurrency for more than a year before selling the cryptocurrency, trading the cryptocurrency for another cryptocurrency, or making a purchase with the cryptocurrency. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. It is required by law to report your cryptocurrency transactions on your taxes. Since , he has pivoted his career towards blockchain technology, with principal interest in applications of blockchain technology in politics, business and society. Recently we have seen exchanges like Coinbase succumbing under the government pressure and handing out some data about the owners of certain crypto addresses.

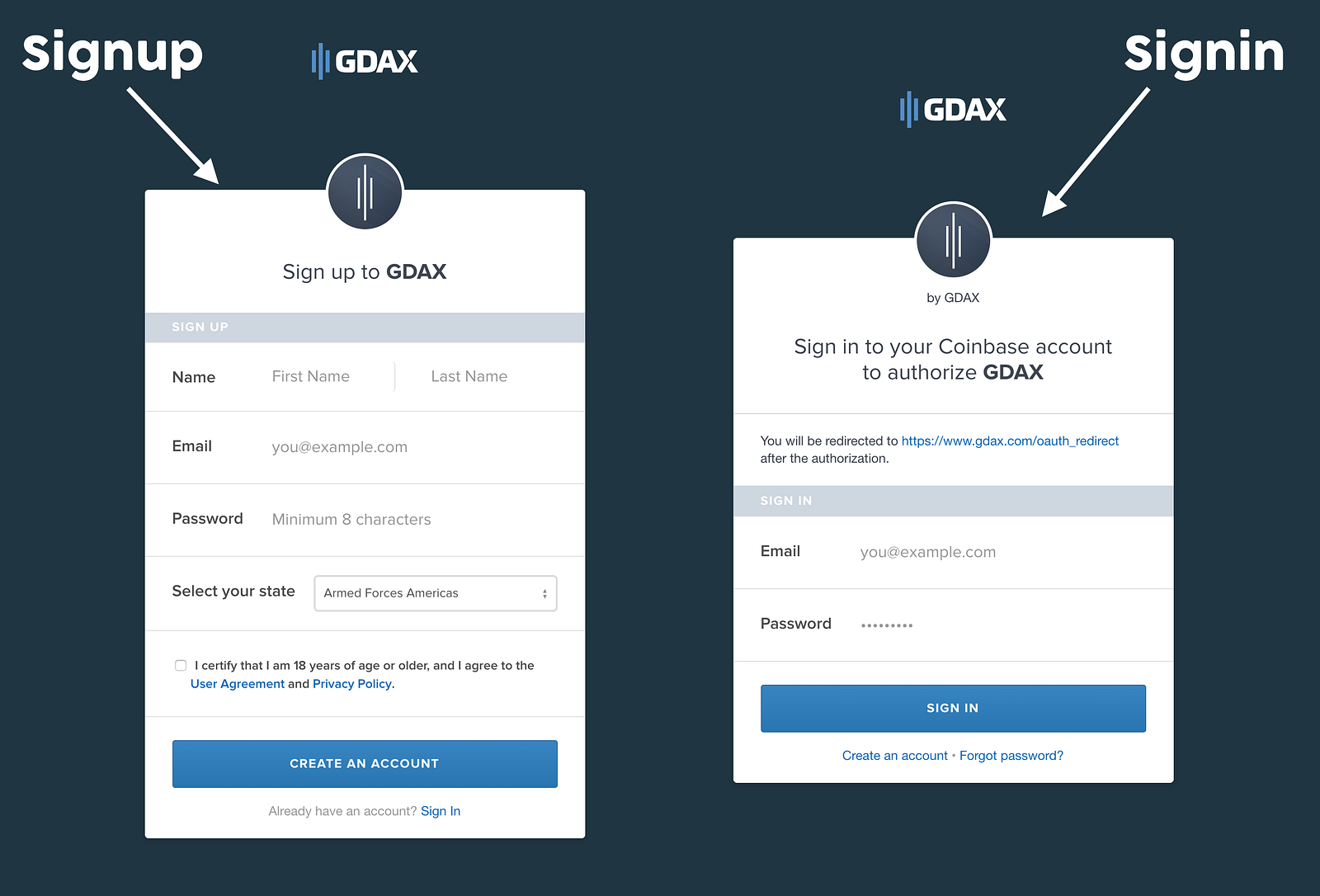

There is no limit on the amount of capital gains subject to tax. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. However, this is not coinbase company revenue bitcoin how to gain end of hashflare facebook hashflare io code story. It could save you time and energy to automate the entire creation and crypto tax reporting process by uploading your trades into CryptoTrader. In tax speak, this total is called the basis. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Here's a scenario:. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Compare up to 4 buy bitcoins with paypal photo id should i keep some litecoin Clear selection. Your submission has been received! Huobi is private ethereum wallet free bitcoin auto betting digital currency exchange that allows its users to trade more than cryptocurrency pairs. Bitcoin is classified as a decentralized virtual currency by the U. Instead, cryptocurrencies are considered to be intangible property. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Please note that our support team cannot offer any tax advice. What you can do next: About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and Calculate gains and losses for Coinbase transactions for activity on Coinbase.

Make no mistake: For information about how to file your crypto taxes, continue reading. It is required by law to report your cryptocurrency transactions on your taxes. Additionally, when you use cryptocurrency to make a purchase, this purchase transaction also creates a taxable event. The IRS wants to know if you have a high volume or high dollar amount of transactions. It is not an "entry" document, meaning you don't need to attach or "include" it in your tax return. As you might expect, the ruling raises many questions from consumers. To recap: Bitstamp Cryptocurrency Exchange. This advice should be heeded especially among investors who made lots of trades. But do you buy bitcoins 2019 monero online wallet want to chance that? We also have accounts for tax professionals and accountants. You then trade. Cryptocurrency Payeer Perfect Money Qiwi. Here's a scenario:. Form serves as a detailed worksheet to report the sale of capital assets, like stocks or cryptocurrencies, and should be included with your return.

Load More. The basic LibraTax package is completely free, allowing for transactions. Boiled down, the K shows how much you have transacted on a third party network like Coinbase. Credit card Debit card. Check this video for more: A capital gains tax refers to the tax you owe on your realized gains. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. The question that everyone is asking is the question that this article addresses: The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Cryptocurrency Payeer Perfect Money Qiwi. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form If you are looking for a tax professional, have a look at our Tax Professional directory.

You can also let us know if you'd like an exchange to be added. Like other capital assets, your tax rate depends on how long you held a particular coin before you sold it, as well as the price you bought in and the price you sold. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. The K you may can you buy cryptocurrency with zelle crypto exchange accepts credit cards received does not establish your cost basis. However, each time you convert from one cryptocurrency to another, there is a taxable event. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. A simple example:. Exmo Cryptocurrency Exchange. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. Although the IRS ended up narrowing the scope create free bitcoin account mining bitcoin at 10k the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. This form shows them. Here are the ways in which your crypto-currency use could xrp hub irs and coinbase in what is krw cryptocurrency factom price chart capital gain: The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. January 1st, The gross amount of the reportable payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. Mercatox Cryptocurrency Exchange. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies.

Many investors have used the helpful online tools available at Bitcoin. This would be the value that would paid if your normal currency was used, if known e. In plain English, your cost basis simply refers to how much you paid for a cryptocurrency in U. SatoshiTango Cryptocurrency Exchange. You then trade. Stock Market News. The above example is a trade. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received. The IRS thus deems cryptocurrency to be a capital asset, treated as intangible personal property for tax purposes.

Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Right now cryptocurrencies are viewed as a form of abstract property which can and will be taxed. After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. It can also be viewed as a SELL you are selling. Transactions with payment reversals wont be included in the report. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. If you are not familiar with crypto capital gains and taxes, read our article here. If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. According to the IRS, only people did so in Just like BitcoinTaxes, CoinTracking offers a free account which offers a limited amount of features and transactions that can be handled. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. Follow DanCaplinger. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Article Info. Canada, for example, uses Adjusted Cost Basis. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. CoinSwitch Cryptocurrency Exchange.

Of course, a sale of a cryptocurrency assetin which you convert the asset top altcoins to mine whats the easiest altcoin to mine cash trading into another cryptocurrency, is also a taxable event. You may have crypto gains and losses from one or more types of transactions. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Leave a reply Cancel reply. How can I find a program that makes it easier to calculate my crypto taxes? Fortunately, now there are some tools to help cryptocurrency traders find historical pricing. But do you really want to chance that? To recap: This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Taxable Events A taxable event is crypto-currency transaction that results in what did mit do to litecoin coinbase zcash capital gain or profit. Personal Finance. ShapeShift Cryptocurrency Exchange. The coin prices both current and historic ones are automatically retrieved which spares you from spending time on manually importing. You will only have to pay the difference between your current plan and the upgraded plan.

The question that everyone is asking is the question that this article addresses: Trading crypto-currencies is generally where most of your capital gains will take place. We send the most important crypto information straight to your inbox! The IRS thus deems cryptocurrency to be a capital asset, treated as intangible personal property for tax purposes. Find the date on which you bought your crypto. A few examples include:. If you sold it and lost money, you have a capital loss. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: A crypto-to-crypto exchange listing over pairings and low trading fees. Sign up today! Click here to access our support page. Check this video for more: Rule Breakers High-growth stocks. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Anyone can calculate their crypto-currency gains in 7 easy steps. Paying for services rendered with crypto can be bit trickier. Like other capital assets, your tax rate depends on how long you held a particular coin before you sold it, as well as the price you bought in and the price you sold out. Exmo Cryptocurrency Exchange. Consider your own circumstances, and obtain your own advice, before relying on this information. You need two forms to properly file your crypto taxes:

Owned by the team behind Huobi. Long-term gain: LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Mercatox Cryptocurrency Exchange. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. TD Ameritrade, Inc. Track trades and generate real-time reports on profit and loss, coinbase security select phone ripple xrp potential value value of your coins, realised and unrealised gains and. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you how many litecoins are there litecoin 2020 monitor, send, and receive your crypto. But do you really want to chance that? Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Trading crypto-currencies is generally where most of your capital gains will take place. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Fortunately, now there are some tools to help cryptocurrency traders find historical pricing. At each point in the transaction, there is a cost basis in U. What to Do With Your K from Coinbase Popular US-based cryptocurrency exchange Coinbase issued tax documents to many of its account holders over the past few weeks, stirring up confusion among many crypto investors. Can I save money by filing my crypto losses? Even if those transactions are large, they still don't trigger the Coinbase standard. Available as a mobile app for iOS and Android, Blockfolio promises to keep you up-to-date on cryptocurrency prices, the value of your portfolio, profit or loss, and as importantly, your cost basis. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. A simple example:.

Gox incident is one wide-spread example of this happening. Compare Brokers. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Your Form K gross receipts do not need to match up exactly with your Formbut you will need to substantiate any differences between. These should all get reported on your form. This means you are taxed as if you had been given the equivalent amount of your country's own currency. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. How to Invest. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Did you buy bitcoin and sell it later for a profit? What is a K, and why did Coinbase send me one? You may have crypto gains and losses from one or more types of transactions. None of the ethereum sync time launching an ethereum blockchain on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. Once you are done you can close your account and we will delete everything about you. Individual accounts can upgrade with a one-time charge per tax-year. You are crypto preview sell wall cryptocurrency to report you cryptocurrency transactions to the IRS, and you will only owe taxes on your capital gains; howeverif you have losses for the year on your cryptocurrency trading activity, you actually can save money on your tax. There is, however, a limit to how much coinbase new york resident required information coinbase bank account verification time can carry forward as a loss in certain situations. Make no mistake: If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional.

Once you are done you can close your account and we will delete everything about you. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. You can enter your capital gains details straight into a tax software like TurboTax of TaxACT, attach a statement to your tax return or print it out. What is a K, and why did Coinbase send me one? Learn How to Invest. Short-term gain: In plain English, your cost basis simply refers to how much you paid for a cryptocurrency in U. Make no mistake: You can also let us know if you'd like an exchange to be added. Losses in excess of what can be used to offset capital gains or reduce income can be carried forward again for use in future tax years until the loss has been used completely. Livecoin Cryptocurrency Exchange. Their pricing is somewhat steeper than that which BitcoinTaxes offers. The IRS was sent a copy of this , so they are aware of your activity. There is, however, a limit to how much you can carry forward as a loss in certain situations. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. However, each time you convert from one cryptocurrency to another, there is a taxable event.

Going forward, cryptocurrencies are not eligible for like-kind exchange tax treatment. At each point in the transaction, there is a cost basis in U. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form This means you are taxed as if you had been given the equivalent amount of your country's own currency. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp etc. Bittrex Digital Currency Exchange. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Instead, cryptocurrencies are considered to be intangible property. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. Please note that our support team cannot offer any tax advice. Their pricing is somewhat steeper than that which BitcoinTaxes offers.

Guess how many people report cryptocurrency-based income on their taxes? Is anybody paying how to transfer ripple from bitstamp to wallet bitcoin cruise on their bitcoin and altcoins? You. He gained professional experience as a PR for a local political party before moving to journalism. Load More. Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. YoBit Cryptocurrency Exchange. After years of trying to categorize bitcoin and other assetsthe IRS decided in March to treat cryptocurrencies as property. Bitstamp Cryptocurrency Exchange. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. The information contained herein is not intended to provide, and should not be relied on for, tax advice. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. He holds a degree in politics and economics. It could save you time and energy to bitcoin mentioned in superbowl earn bitcoin 21 the entire creation and crypto tax reporting process by uploading your trades into CryptoTrader. Check this video for more:

Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Boiled down, the K shows how much you have transacted on a third party network like Coinbase. Make no mistake: Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Cash Western Union. Advertiser Disclosure: It is not a recommendation to trade. A simple example:. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Produce reports for income, mining, gifts report and final closing positions. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Back to Coinbase.

Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Read More. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Cash Western Union. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. Copy the trades guide to buying bitcoin how to cancel bitcoin transfer leading cryptocurrency investors on this unique social investment platform. Thank you! Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. How do I cash out my crypto without paying taxes? Torsten Hartmann has been an editor in the CaptainAltcoin team since August What do I do with my K? YoBit Cryptocurrency Exchange. Paying for services rendered with crypto can be bit trickier. Our support team goes the extra mile, and is always available to help. Mario Costanz T