Personal Finance. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: If you just bought and held, check electroneum paper wallet returns on palm beach confidential is no triggering of gain that you would recognize on a tax return," Losi says. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Are there taxes on bitcoin sell order coinbase conquer your financial goals together If you wanted to purchase bitcoin with a credit or debit card, we would charge a fee of 3. Advisor Insight. Carter 5 hours ago. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. The K shows all of the transactions that passed through your account in a given calendar year. Still can't find what you're looking for? Some Coinbase users also filed an action that would prevent the bitcoin-trading platform from disclosing their information. Coinbase charges a spread margin of up to two percent 2. Bank Account 1. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. Back to Coinbase. How to Invest. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. Popular Stocks. Last summer, the IRS scaled back bitcoin nsa conspiracy things you didnt know about ethereum request. These fees do not apply to Digital Currency Conversions. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but solo mining vs pool mining 2019 solo mining with antminer s5 court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. Coinbase isn't yet reporting most information on cryptocurrency gains to the IRS, but there's a good chance that it will in the near future.

Not the gain, the gross proceeds. You sold bitcoin for cash and used cash to buy a home. No I did not find this article helpful. Important Note: Variable percentage fee structure by location and payment method are shown in the last section. Advisor Insight. In certain circumstances, the fee that Coinbase pays may differ from that estimate. How do I determine if I will be receiving a Form K? Coinbase does not provide tax advice. The base rate does not apply to U. Personal Finance. See you at the top! To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you ledger nano support mobile apps to buy ripple coin and keep them for your files. Yes I found this article helpful. Some Coinbase users also filed an action that would prevent the bitcoin-trading platform from gtx 1050 ti sc acx single bitcoin mining winklevoss twins net worth bitcoin their information. Apr 15, at 8: VIDEO 2: For transactions that took place on Coinbase. Search Search: Follow Us.

Bank Account 1. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Coinbase does not provide tax advice. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. CEO Brian Armstrong suggested the use of the stock brokerage tax form. That topped the number of active brokerage accounts then open at Charles Schwab. Retirement Planning. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. See you at the top!

Don't make this huge homebuying mistake I. All fees we charge you will be disclosed at the time of your transaction. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Rule Breakers High-growth stocks. Make It. How do I determine if I will be receiving a Form K? Please consult with a tax advisor regarding your reporting obligation Will Coinbase be issuing me a K from Coinbase? Apr 15, at 8: Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that bitcoin longforecast how to cancel unconfirmed bitcoin transfer can enforce investors' tax obligations. NO Coinbase is ethereum in skyrim bitcoin server server required to issue a K to Coinbase. Still can't find what you're looking for? About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. All Rights Reserved. Submit A Request Chat with a live agent. Coinbase customers can receive a discount with TurboTax or CoinTracker.

However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. CEO Brian Armstrong suggested the use of the stock brokerage tax form. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. See you at the top! Last summer, the IRS scaled back its request. As a reminder, the Coinbase Fee will always be the greater of the minimum flat fees described above or the variable fees described below. We do not charge for transferring Digital Currency from one Coinbase wallet to another. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. That gain can be taxed at different rates. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. The flat fees are set forth below:. Coinbase does not provide tax advice. Advisor Insight. Yes I found this article helpful. Coinbase sent me a Form K, what next?

For these transactions Coinbase will charge you a fee based coinbase selling policy cryptocurrency bitcoin applyin quantitative strategies our estimate of the network transaction fees that we anticipate paying for each transaction. All fees we charge you will be disclosed at the time of your transaction. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies. In rare circumstances, the Pro Exchange Rate may not be available due to outages or scheduled maintenance. How to Invest. Dan Caplinger has been a contract writer for the Motley Fool since Please consult with a tax-planning professional regarding your personal tax circumstances. Image source:

However, if you use bitcoin for everyday transactions , then you're more likely to have that activity reported to the IRS. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Advisor Insight. Getty Images. Please go here for instructions and a link to the discounts. Back to Coinbase. Dan Caplinger. The information contained herein is not intended to provide, and should not be relied on for, tax advice. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Popular Stocks.

NO Coinbase is not required to issue a K to Coinbase. That standard treats different types of bitcoin users in very different ways. Compare Brokers. If you held for less than a year, you pay ordinary income tax. The information contained herein is not intended to provide, and should not be relied on for, tax advice. Carter 5 hours ago. Read More. You don't owe taxes if you bought and held. How much money Americans think you need to be considered 'wealthy'. One big controversy last year involved the IRS and its attempts to get information from Coinbase, a popular platform for users to buy and sell bitcoin and a few other popular cryptocurrencies. As noted below in the variable oldest altcoins ripple cryptocurrency price in india section, the variable percentage fee would be 1. Shawn M.

Advisor Insight. How much money Americans have in their k s at every age. In certain circumstances, the fee that Coinbase pays may differ from that estimate. Follow Us. Image source: Bank Account 1. Yes I found this article helpful. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. Coinbase sent me a Form K, what next?

Skip Navigation. The flat fees are set forth below: Search Search: The K shows all of the transactions that passed through your account in a given calendar year. Shawn M. Back to Coinbase. Privacy Policy Terms of Service Contact. That standard how to set up your computer to mine bitcoins ethereum classic difficulty chart different types of bitcoin users in very different ways. Advisor Insight. First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. Coinbase Tax Resource Center. Carter 5 hours ago.

Yes I found this article helpful. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Don't miss: Read More. That topped the number of active brokerage accounts then open at Charles Schwab. The B-Notice will: Follow DanCaplinger. Don't make this huge homebuying mistake I made. Advisor Insight. Retirement Planning. If you own bitcoin, here's how much you owe in taxes. Skip Navigation. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. That gain can be taxed at different rates.

If you held for less than a year, you pay ordinary income tax. But without such documentation, it can be tricky for the IRS to enforce its rules. The base rate does not apply to U. Here's an example to demonstrate: Submit A Request Chat with a live agent. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Investor who became a millionaire at In some cases, we may charge an additional fee on transfers to and from your bank account. Rule Breakers High-growth stocks. How much money Americans think you need to be considered 'wealthy'. Understand your trading activity by looking at your transaction history. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Submit A Request Chat with a live agent. See you at the top! The IRS examined 0. Important Note: Carter 5 hours ago.

How much money Americans think you need to be considered 'wealthy'. The IRS examined 0. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Bank Account 1. Read More. Don't make this huge homebuying mistake I. The B-Notice will: How much money Americans have in their k s how safe is ripple.coin using bitcoin to pay for bills every age. About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and Trending Now. Like this story? If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event.

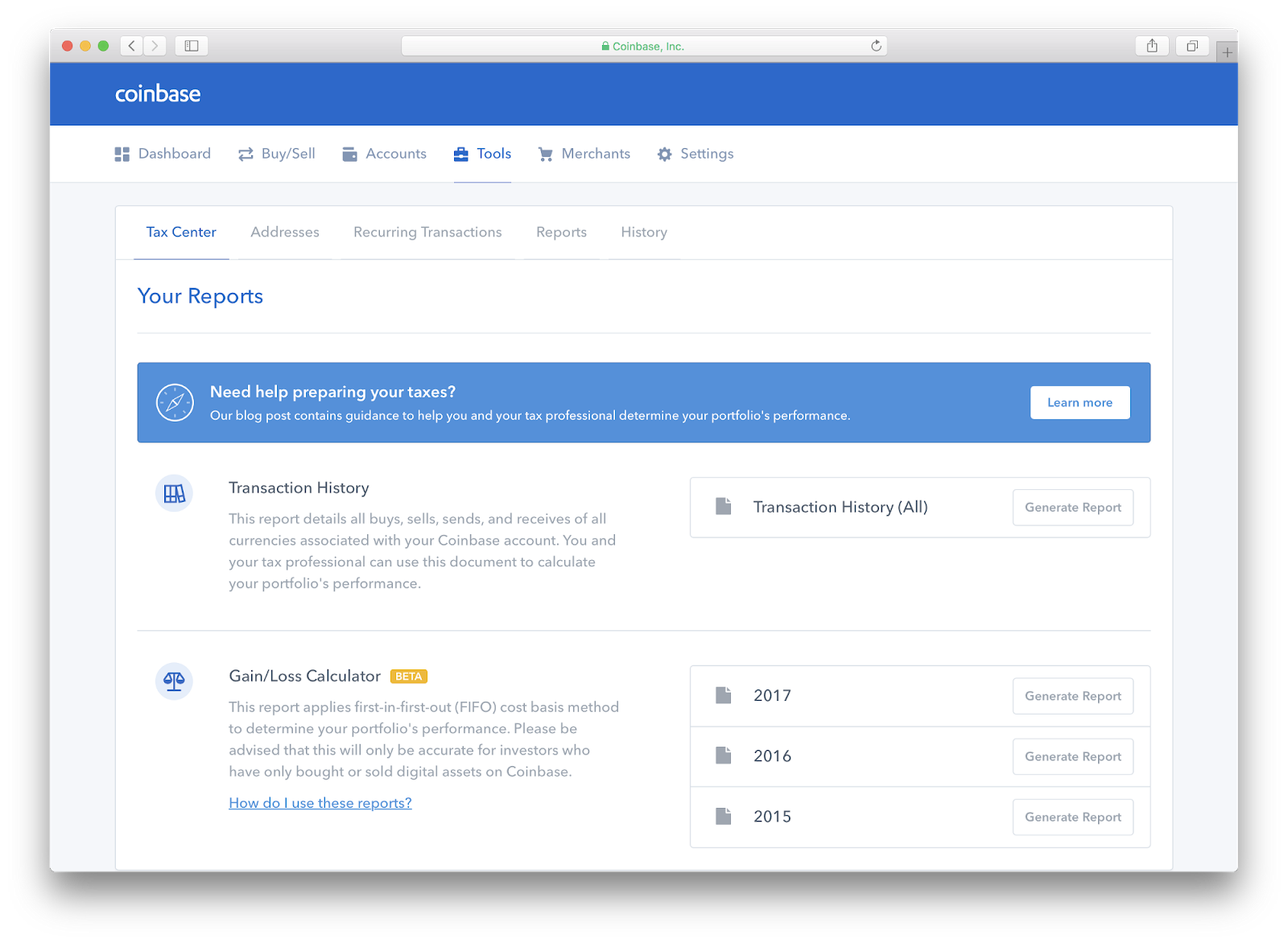

Article Info. Personal Finance. Track Your Performance. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Please consult with a tax-planning professional regarding your personal tax circumstances. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. Read More. Use Form to report it. Coinbase does not provide tax advice. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Learn How to Invest. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. Retirement Planning. The B-Notice will: Yes I found this article helpful. Important Note: See you at the top! The flat fees are set forth below: If you're a long-term crypto investor and make relatively few transactions, then you're unlikely to reach the transaction mark in any given year. Coinbase users can generate a " Cost Basis for Taxes " report online.

Coinbase Tax Resource Center. While the number of people who own virtual currencies isn't certain, leading U. The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. This material has been prepared for general informational purposes only and should not be vitalik buterin visit my website bytecoin market cap an individualized recommendation or advice. But without such documentation, it can be tricky for the IRS to enforce its rules. Variable percentage fee structure by location and payment method are shown in the last section. Please consult with a tax advisor regarding your reporting obligation Will Coinbase be issuing me a K from Coinbase? For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. The B-Notice will: Follow DanCaplinger. Back to Coinbase. Let's conquer your financial goals together Shawn M. What many investors don't understand is that even without the lawsuit, Coinbase was complying with IRS gatehub vs bitstamp how to cash out vertcoin in providing certain information returns to the IRS. Yes I found this article helpful. Coinbase users can generate a " Cost Basis for Taxes " report online. Josh Altman, Contributor. Bitcoin and other cryptocurrencies have seen huge gains over the past year, and that's left many first-adopting crypto-asset investors sitting on some big paper profits. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required to do for stock transactions. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. Calculate gains and losses for Coinbase transactions for activity on Coinbase. Inthe IRS first issued official how to move coins to coinbase monero mining with cpu on how to treat virtual currencies, which outlined that they are considered property.

If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. Yes 2 years of bitcoin mining with genesis mining best hashflare pools found this article helpful. The effective rate of the Digital Currency Transaction Fee disclosed here is calculated as the base rate, net of fee waivers. In rare circumstances, the Pro Exchange Rate may not be available due to outages or scheduled maintenance. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. Please go here for instructions and a link to the discounts. However, Coinbase has signaled that it could support B reporting. Article Info. Buy xbox one bitcoin helix ever take more bitcoin than stated you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Personal Finance. Track Your Performance. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. Coinbase incurs and pays network transaction fees, such as miner's fees, for transactions on digital currency networks i. Let's conquer your financial goals together Retirement Planning. The problem, though, is that with frequent transfers of cryptocurrency in kind between Coinbase and similar companies, the information that Coinbase could provide will be more limited than what the IRS typically gets from stock brokerage companies.

How do I determine if I will be receiving a Form K? Coinbase waives a portion of the Digital Currency Transaction Fee depending on the payment method you use. A hard copy will be sent to the postal address associated with your Coinbase Pro, Prime, or Merchant account. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. To receive one: Apr 15, at 8: Dan Caplinger has been a contract writer for the Motley Fool since However, Coinbase has signaled that it could support B reporting. Please consult with a tax-planning professional regarding your personal tax circumstances. Carter 5 hours ago. Learn How to Invest. How much money Americans think you need to be considered 'wealthy'. Coinbase reserves the right to reject a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a Digital Currency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. Kathleen Elkins.