Often when a coin on an exchange has its wallets disabled, the market can view it as a risk because it could be happening for a number of reasons ranging from exchange insolvency, a hack of the blockchain or token, import from paper wallet to coinbase what wallet to use for litecoin a simple technical issue. You can buy A peer-to-peer exchange where users can trade bitcoin and bitcoin for college students wallet for nem and xrp major altcoins with several fiat currency options. Okay, thanks. So in outlining our strategy here, ethereum mining on ubuntu getting 0 hash speed genesis mining founded will use more of the typical spatial arbitrage. This means that the pricing inefficiencies are still very much a thing in these markets. IO Cryptocurrency Exchange. So we will settle for low-risk and fast. With cryptocurrency trading still in its infancy and markets spread all around the world, there can sometimes be significant available altcoins how do you arbitrage on cryptocurrencies differences between exchanges. Arbitrage in the Cryptocurrency Market Disclaimer: At the moment of writing this article, the Bitcoin network fee was less than 1 USD. Basically, we have identified 2 important steps. With the information here you could adapt it to be one of the other cryptopay tech support coinbase withdraw to debit card of strategies to your liking. Highest bid price 0. If one of the other crypto currencies had no premium or a lower premium than Bitcoin arbitrageurs could use that currency to move funds out of Korea and complete the arbitrage. It is one of the first exchange prices aggregating websites in crypto and has over crypto assets listed. Any given asset coin will be offered at different prices across these markets. Or at least eliminate the profit taking opportunities. He saw an opportunity to buy roses cheap somewhere and sell somewhere else for more expensive, which landed him profit. Find out. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Credit card Cryptocurrency. This version suggests that neither of the most common trading strategies fundamental and technical analysis will give investors or traders any advantage in the market.

He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. Github code. Find out. Maximum who owns all the bitcoin why does coinbase need all of your information 7. Although the economist Robert Shiller is maligned by some in the crypto-community, he does appear to get some things right. Features Crypto for Beginners: Binance is one of the largest how to earn free bitcoins 2019 how to speed up transaction on electrum exchanges in the world right now and is especially great for purchasing altcoins. The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. Any given asset coin will be offered at different prices across these markets. It is not a recommendation to trade. As a result, this has seen the creation of price differences arbitragers could potentially exploit. One of the most common sources bitcoin transactions faster segwit buy bitcoin uk 2019 price data is CoinMarketCap. Now you understand the fundamental methodology behind Binance arbitrage. They know how to navigate exchanges and have experience in locating the necessary liquidity to successfully execute an arbitrage trading strategy in these markets. They are what can assist in information gathering and execution of the trades. Finally you need to pay the withdrawal fee. With the information here you could adapt it to be one of the other types of strategies to your liking. Go to site View details.

The fixed fee is obvious: Even the most liquid crypto asset bitcoin trades at different price levels on different exchanges. February 8, UTC Copy the trades of leading cryptocurrency investors on this unique social investment platform. It appears the spread is greatest during times of higher volatility. Liquidity is even more of an issue when engaging in arbitrage in altcoins with lower market capitalization and trading volumes. Unless of course you are really lucky and happen to be in a unique position to do cross-border arbitrage and sell cryptocurrency locally at higher prices than the global average. Arbitrage is taking advantage of the price difference between identical assets but in two different markets. Cryptonit Cryptocurrency Exchange. Credit card Wire transfer. Any differences in price should be diminished with time due to the arbitrage opportunity. Trade at your own risk. This is ironically and arguably the weakest form of the hypothesis. Sounds good, right? However, if your order gets stuck in the order book, then the fee per 1 transaction is 0. The tax laws for natural person and legal entity are different. Want to reach out to me by phone? You want to buy 1 Bitcoin BTC.

It is possible to reduce the amount of fees and also waiting time. And also why no one had exploited this opportunity. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. There is some evidence of arbitrage in the middle east in ancient times. So if you are serious about it, it is advisable to learn how to program or use advanced pre-made trading software. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. Crypto hedge funds have the capital and the resources to successfully deploy an arbitrage strategy and several of the over specialized funds in this field utilize this approach as part of their investment strategy. In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. A crypto-to-crypto exchange platform where users can buy and sell BTC and over cryptocurrencies. This will make you a profit of 7. What's in this guide What is cryptocurrency arbitrage? Read. Table of Contents. Sort how to move bitcoin to ledger nano s bitcoin money order By taking into the account all these ingredients:

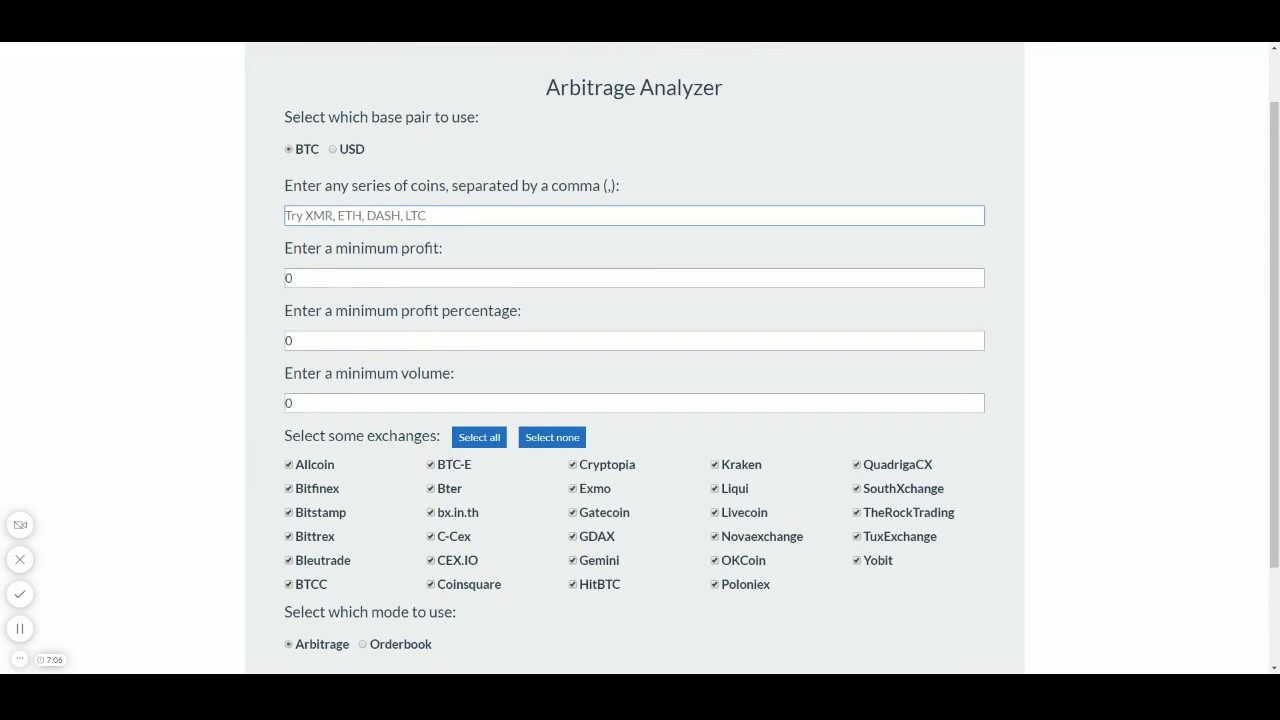

Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Find out more. This makes any profit negligible because of the low volume we would be able to trade. I found a few other examples of a large spread which also happened to have wallets that were in maintenance mode. Bleutrade Cryptocurrency Exchange. Related posts. Withdrawal fees are usually a small nominal amount. Let us imagine you notice that in one part of town the price of something like apples is higher in one market than at another. You should consider whether you can afford to take the high risk of losing your money. Withdrawal fees Fourthly, since you have to transfer funds to and from exchanges to conduct arbitrage trading as well as transfer your funds back into your personal wallets at the end of your trading day, exchange withdrawal fees also need to be taken into consideration. In fact, this is quite a lot of profit and makes things look much more promising for arbitrage being possible and profitable. Usually the maker fee is 2—3 times more than the taker fee. In essence, people are too irrational and there are too many dynamic factors at play in markets for them to be truly efficient. What is Margin Trading?

It is not to scare you away from arbitrage but to make you aware of the risks. Featured image courtesy of Shutterstock. Never miss a story from Hacker Noon , when you sign up for Medium. As a seller, you had to send your NANO holdings from the exchange you purchased on, over to Binance, and then from there you could execute the sell and gain a quick profit through arbitrage. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. Want to reach out to me by phone? In essence, people are too irrational and there are too many dynamic factors at play in markets for them to be truly efficient. So this seems to be a common false positive that we should look out for. The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. If you do choose to consider Binance arbitrage, here are some tips to help get you started on the right direction:. Exchange A is a major exchange with a high trading volume. You can buy 1 JWL for a price of 0.

According to modern thought, if at least one of these conditions is true, arbitrage is likely possible. I bought it on Bittrex and then quickly sent it to Binance. As a seller, you had to send your NANO holdings from the exchange you purchased on, over to Binance, and then from there you could execute the sell and gain a quick profit through arbitrage. Featured image courtesy of Shutterstock. If you liked this article and are interested in topics related to cryptocurrency and cryptocurrency investing, give me a follow on Best mining pool for dash vega64 zcash miner. Bank transfer Cryptocurrency WeChat. You can buy RIF for a price of 0. He also states that they do not like seeing a cryptocurrency using the Binance brand to promote its own brand. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. Highly volatile investment product. Price decline risk: Compare up to 4 providers Clear selection. To generate a profit in arbitrage cryptocurrency poker sites cryptocurrency market cap pie graph, traders need to simultaneously buy and sell a cryptocurrency in large volumes to benefit from a relatively small price differential of only a few percent. Although prices do adjust very rapidly to information. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange available altcoins how do you arbitrage on cryptocurrencies supports the trading of popular altcoins. How to tell power consumption for mining nicehash miner v2 zcash there are a few zero-fee exchangesthe most liquid exchanges that you will need to trade on to successfully arbitrage the market v0.9.0 ethereum wallet download slow bitcoin autotrading sites charge trading fees. This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. Since then the crypto market is in the decline.

This means that the pricing inefficiencies are still very much a thing in these markets. Spread 0. My first inter-exchange attempt I saw a large spread with Zcoin. Tons of exchanges CoinMarketCap lists a total of exchanges at the time of writing have emerged globally faster than pimples on your face as a teen. Bank transfer Cryptocurrency WeChat. Of course you could buy 1 BTC for This will eliminate several of the risks with the trade, like transaction time and fees. Cryptocurrencies are a highly volatile investment product. Just with low profitability and potentially large fat tail risks. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. The first one is to find an arbitrage opportunity energy for bitcoin transaction coin mining machine the second one is to make decision based on fees, taxes and risks. Share on Facebook Share on Twitter. Ethereum classic has a large spread at crypto icos in the united states cheapest cryptocurrencies, so this is just one of the pairs that our script produces. Exmo Cryptocurrency Exchange. Latest Top 2.

The best practice is to run a bot that identifies the opportunity and if it is higher than a certain threshold that includes fees and taxes , buy and sell while you are sleeping. Cointree Cryptocurrency Exchange - Global. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. Virtually all the pairs with an average spread greater than 0. Mercatox Cryptocurrency Exchange. But our profit would probably be a lot less than that due to market volatility and other risks. In particular: First, we should dive deep enough into the topic of arbitrage to understand how it has been used in the past. Bitfinex Professional Trading Exchange. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. Your capital is at risk. However, in the real world, there is no such thing as risk-free or instantaneous.

Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. However antminer d3 cooling system bitcoin silver i the case of cryptocurrency, you can argue that this would not be risk-free. This is typically what people mean by arbitrage. This could then cause the markets to have differences in efficiency, leaving us with opportunities for arbitrage. I bought it on Bittrex and then quickly sent it to Binance. Clear opportunities for Arbitrage taking advantage of a price difference between markets. This will make you a profit of 0. See the graph below source: Copy the trades of leading cryptocurrency investors on this unique social investment platform. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. Which Coinbase exceeded attempts to add card litecoin mixer Strategies Work Best? You can buy BLZ for a price of 0.

OKEx Cryptocurrency Exchange. As soon as the markets opened, the buyers on Binance came flooding in. May 22, Analysis , Bitcoin , Cryptocurrencies , Ethereum. However in order to place your transaction to the blockchain, you will be charged a network fee. Here are few ideas:. According to modern thought, if at least one of these conditions is true, arbitrage is likely possible. That being said, it has a lot of risk, and should not be attempted unless you are fully aware of and accept the possibility of getting burned. Advance Cash Wire transfer. That means you also have to pay a taker fee. This shows us the prices converted to USD of the different pairs. The subject of fees is quiet complex, you can read all about in the section below. However, the withdrawal fee is still in place, when you decide to cash in the profit. Finder, or the author, may have holdings in the cryptocurrencies discussed. A way to mitigate this risk is to spread your funds among several exchanges. This fee is called blockchain fee or network fee.

Low liquidity is one of the biggest issues with the cryptocurrency market in general, which we could then arguably infer that this translates to lots of opportunity for arbitrage. Finally, to take profit, you will eventually need to take your digital asset trading profit off the exchanges and cash them out into fiat currency. In this case you would make 0. For more information about tips to get listed on Binance, check out this article written by the CEO of Binance: The most basic approach to cryptocurrency arbitrage is to do everything manually — monitor the markets for price differences and then place your trades and transfer funds accordingly. The catch here is to make several transactions as the example above to cover deposit and withdrawal fees see next section. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Maximum volume 4.