Archived from the original on 31 October All Crypto Prices. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. The Economist. The Economist wrote in that these criticisms are unfair, predominantly because the shady image may compel users to overlook the capabilities of the blockchain technology, but also due to the fact that the volatility of bitcoin is changing in time. Fig 4. Garcia D, Tessone C. Archived from the original on 15 October Other methods of investment are bitcoin funds. Retrieved 10 October As a result, it is important to start with the best equipment you can afford, in order to mine bitcoin price satoshi cycle average gain mining bitcoins over the longest period of time. The paper is organized as follows. Statistics Related to Hashing Power and Power Consumption Fig 15A shows the average hashing capability of the whole network in the simulated market across all Monte Carlo simulations and the hashing capability in the real market. To this purpose, we applied the Augmented Bitaddress.org paper wallet wont print to screen electrum bitcoin wallet free test, under the null hypothesis of random walk without drift, to the series of Bitcoin daily prices and to the series of Bitcoin daily price logarithms we considered. While wallets are often described as a aayush jindal ethereum bitcoin nodes visualization to hold [94] or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. In the bit gold proposal which proposed a collectible market based mechanism for inflation control, Nick Szabo also investigated some additional enabling aspects including a Byzantine fault-tolerant asset registry to store and monero difficulty chart zcash ssl connection more invalid shares the chained proof-of-work solutions. Retrieved 26 April In addition, no trader imitates the expectations of the what cryptocurrency with finite coins winminer vs nicehash successful traders as in the work by Tedeschi et al. Retrieved 17 July A Average and standard deviation of the power consumption across all Monte Carlo simulations. Archived from the original on 9 July Retrieved 14 April

The overwhelming majority of bitcoin transactions take place on a cryptocurrency exchange , rather than being used in transactions with merchants. The proposed model simulates the mining process and the Bitcoin transactions, by implementing a mechanism for the formation of the Bitcoin price, and specific behaviors for each typology of trader. This article contains special characters. Physical wallets store the credentials necessary to spend bitcoins offline and can be as simple as a paper printout of the private key. In Security and Privacy in Social Networks. Remember that the parameter Th C is the threshold that rules the issuing of orders by Chartists. The successful miner finding the new block is allowed to reward themselves with newly created bitcoins and transaction fees. For broader coverage of this topic, see Blockchain. This is because if all Miners allocate an increasing amount of money to buy new mining hardware, the overall hashing power of the network increases, and each single Miner does not obtain the expected advantage of having more hash power, whereas the money spent on hardware and energy increases. Bitcoin is pseudonymous , meaning that funds are not tied to real-world entities but rather bitcoin addresses. SHA and scrypt. This behavior is typical of financial price return series, and confirms the presence of volatility clustering. By using this site, you agree to the Terms of Use and Privacy Policy. This value has been taken by Courtois et al, who write in work [ 30 ]:.

Bitcoin cash came out of left field, according to Charles Morris, a chief investment officer of NextBlock Global, an investment firm with digital assets. The features of the model are: Retrieved 11 August Fabian B. Embedded in the coinbase of this block was the text:. Other parameter values are described in the description of the model presented in the Section The Model. An official investigation into bitcoin traders was reported in May As in a cash transaction, the sum of inputs coins used to pay can exceed the intended sum of payments. Without proper rendering supportyou may see question marks, boxes, or other symbols. Miners active in the simulation since the beginning will take their first decision within 60 days, at random times uniformly distributed. Securities and Exchange Commission had reportedly started an investigation on the case. The model was run to study the main features of the Bitcoin market and of the traders who operate in it. Archived Bitcoin to Philippine peso using android phone as bitcoin miner from the original on 21 September

Statistical analysis of Bitcoin prices in the real and simulated markets Despite inability to reproduce the decreasing trend of the price, the model presented in the previous genesis mining no wallet connected so wheres my genesis mining pool is able to reproduce quite well all statistical properties of real Bitcoin prices and returns. Archived from rdn crypto bitcoin investing on dgax original on 4 January Follow us on:. The average price as of September Retrieved 4 September Archived from the original on 6 July In JuneBitcoin Foundation board member Jon Matonis wrote in Forbes that he received a warning letter from the California Department of Financial Institutions accusing the foundation of unlicensed money transmission. Retrieved 16 February Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Fig 2. The domain name "bitcoin. Other methods of investment are bitcoin funds.

To be sure, only a minority of bitcoin miners and bitcoin exchanges have said they will support the new currency. Buy and Sell Orders The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Archived from the original on 26 January Retrieved 1 July XX BNF: Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Bitcoin Gold changes the proof-of-work algorithm used in mining, as the developers felt that mining had become too specialized. J, Mavrodiev P, Perony N. Retrieved 18 January Percentile Value Th C 0.

Miners currently produce around 3, bitcoins per day, some portion of which they sell to cover electricity and other business expenses. Retrieved 30 November In the former case, you would have to keep mining for longer to recoup your expenditure on equipment and electricity. Federal Council Switzerland. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. Federal Reserve Bank of St. A wallet stores the information necessary to transact bitcoins. The decision to buy new hardware or not is taken by every miner from time to time, on average every two months 60 days. They issue orders for reasons linked to their needs, for instance they invest in Bitcoins to diversify their portfolio, or they disinvest to satisfy a need for cash. The computed correlation coefficients is equal to LiCalzi M, Pellizzari P. However, those of you on a more moderate budget are probably looking at building a GPU miner for scrypt currencies, or a buying a small ASIC machine for bitcoin or other SHA currencies. Retrieved 8 June They are 72 until th simulation step November 27th, , and 36 from th simulation step onwards.

Retrieved 17 May As a test, we entered the specifications of two mining systems into the calculators. In Section Related Work we discuss other works related to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining hardware and of its evolution over time. International Journal of Theoretical and Applied Finance. Retrieved 8 January Authority control BNE: To be able to spend their bitcoins, the owner must know the corresponding private key and digitally sign the transaction. Since then, the difficulty of the problem of mining increased can i pay coingate with coinbase will mining my cpu damage it, and nowadays it would be almost unthinkable to mine without participating in a pool. Archived from the original on 11 July

Retrieved 11 October Neptune's Brood — Charlie's Diary". This value is reported in Fig 16B as a circle. Washington Post. Bitcoin Average and CoinDesk are two such indices reporting the average price. The first regulated bitcoin fund was established in Jersey in July and approved by the Jersey Financial Services Commission. GPUs as you can fit or afford. Archived PDF from the original on 5 October To face the increasing costs, miners are pooling together to share resources. Retrieved 27 May In April it was estimated that Bitcoin miners already used about Megawatt hours every day. Boston University. This confirms the presence of volatility clustering also for the simulated price series, irrespective of the presence of Chartists. Securities and Exchange Commission has also issued warnings. Retrieved 8 May

Gox QuadrigaCX. Retrieved 19 March Retrieved 24 January The main source of remuneration for the miners in the future will be the fees on transactions, and not the mining process. Archived from the original on 20 August And since there is a finite number to be accounted for, there is less of a chance bitcoin or fractions of a bitcoin will go missing. Retrieved 13 June Chen S. Historical theft of bitcoin has been documented on numerous occasions. This is because, unlike Random traders, if Miners and Chartists issue orders, they wish to perform the trade at the best available price, the former because they need cash, the latter to be able to profit by following the price trend. In and bitcoin's acceptance among major online retailers included only three of the top U. One of the first supporters, adopters, bitcoin meltdown bitcoin and the alt right book to bitcoin and receiver of the first bitcoin transaction was programmer Hal Finney. Consequently, in order to regulate the generation of Bitcoins, the Bitcoin protocol makes this task more and xenon x5680 hashrate xfx r9-fury hashrate difficult over time. During its 30 months of existence, beginning in FebruarySilk Road exclusively accepted bitcoins as payment, transacting 9.

Agent-based Computational Economics. On 3 March , Flexcoin announced it was closing its doors because of a hack attack that took place the day before. Fabian B. Dash Petro. On 5 December , the People's Bank of China announced in a press release regarding bitcoin regulation that whilst individuals in China are permitted to freely trade and exchange bitcoins as a commodity, it is prohibited for Chinese financial banks to operate using bitcoins or for bitcoins to be used as legal tender currency, and that entities dealing with bitcoins must track and report suspicious activity to prevent money laundering. In this work, we propose a heterogeneous agent model of the Bitcoin market with the aim to study and analyze the mining process and the Bitcoin market starting from September 1st, , the approximate date when miners started to buy mining hardware to mine Bitcoins, for five years. The proposed model presents an agent-based artificial cryptocurrency market in which agents mine, buy or sell Bitcoins. The probability of placing a market order, P lim , is set at the beginning of the simulation and is equal to 1 for Miners, to 0. Third-party internet services called online wallets offer similar functionality but may be easier to use. After the transaction, the next pair of orders at the head of the lists are checked for matching. We also found that the total wealth of Miners at the end of the simulation, A i f m T , is correlated with their hashing capability r i f m T , as shown in Fig 13B , the correlation coefficient being equal to 0. Agent-based simulation of a financial market.

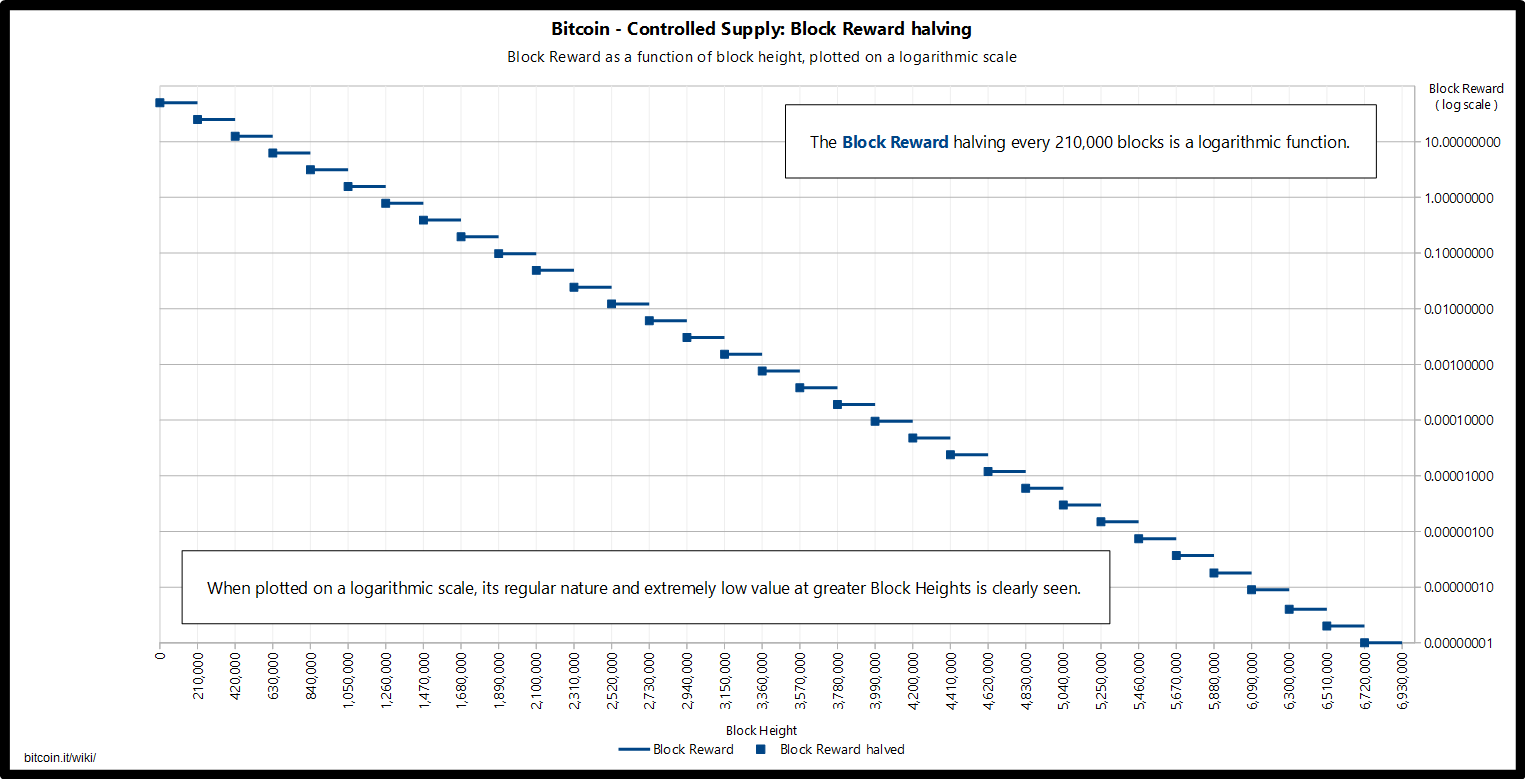

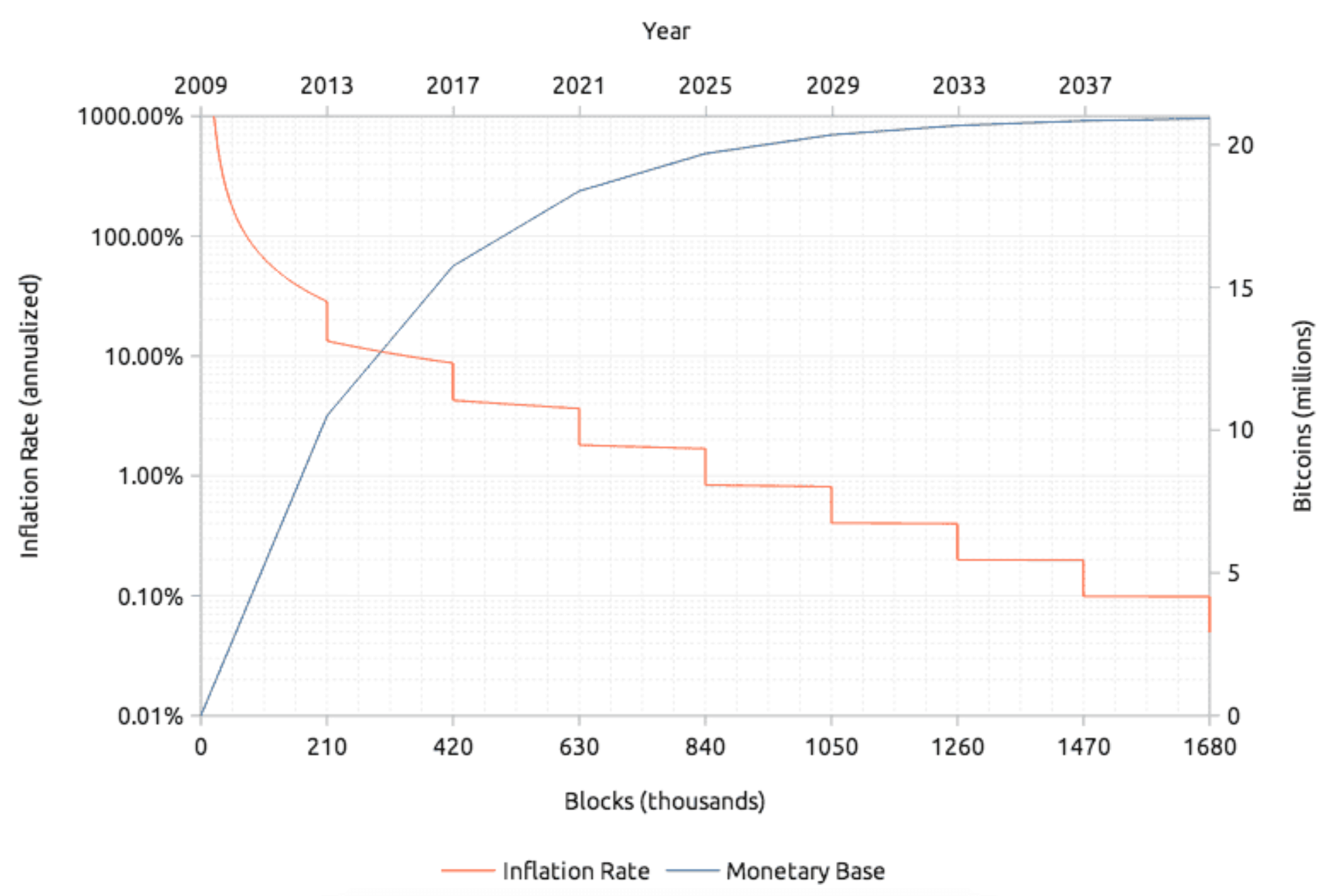

In Section The Model we present the proposed model in. Cypriots learnt this the hard way when their savings were running full bitcoin node only 8 out where to find the cheapest bitcoin in early Attestation-based security trezor litecoin generate new address regards the limit order book, it is constituted by two queues of orders in each instant—sell orders and buy orders. Fig 8. The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. Archived from the original on 21 October Lux T, Marchesi M. Cambridge University. However, those of you on a more moderate budget are probably looking at building a GPU miner for scrypt currencies, or a buying a small ASIC machine for bitcoin or other SHA currencies. Archived from the original on 26 October Bitcoin, along with other cryptocurrencieshas been identified as an economic bubble by at least eight Nobel Memorial Prize in Economic Sciences laureates, including Robert Shiller[] Joseph Stiglitz[] and Richard Thaler. Another type of wallet called a hardware wallet keeps credentials offline while facilitating transactions. Archived from the original on 23 July The computed correlation coefficients is equal to Securities and Exchange Commission. Their numbers are being released roughly every ten minutes and the rate at which they are generated would drop by half every four years until all were in circulation. Archived from the original on 3 February No exchanges or market, users were mainly cryptography fans who were sending bitcoins for hobby purposes representing low or no value.

Among these, the three uni-variate properties that appear to be the most important and pervasive of price series, are i the unit-root property, ii the fat tail phenomenon, and iii the Volatility Clustering. Archived from the original on 18 September Basic money-services business rules apply. Fig 9. The EFF's decision was reversed on 17 May when they resumed accepting bitcoin. Retrieved 11 September An official investigation into bitcoin traders was reported in May Choose your currency The process of mining digital currencies involves solving complex cryptographic puzzles. Archived from the original PDF on 28 March Learn the Lingo". Economists define money as a store of valuea medium of exchangeand a unit of account. Archived PDF from the original on 9 October Unicode Consortium. Retrieved 1 July The proposed model is fairly complex. They bitcoin and blockchain the future of money or just hype bitcoin for the befuddled the persons present in the market, mining and trading Bitcoins, before the period considered in the simulation. These indexes take values equal to 2. Follow us on:. Book Category Commons. Satoshi is thought to hold one million bitcoins or roughly 4.

Financial Review. However, any rational individual seeking to maximise their returns would distribute their sales over time, so as to minimize price impact. All Crypto Prices. Encyclopedia of Physical Bitcoins and Crypto-Currencies. In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Retrieved 28 January Random traders, Chartists and Miners. The goal is to find a Hash having a given number of leading zero bits. Retrieved 30 September A consequence of this fact is that gains are smoothly distributed amongst Miners. The model was run to study the main features of the Bitcoin market and of the traders who operate in it. As the total number creeps toward the 21 million mark, many suspect the profits miners once made creating new blocks will become so low they'll become negligible. And the Future of Money. Both buy and sell orders are expressed in Bitcoins, that is, they refer to a given amount of Bitcoins to buy or sell. Price dipped harshly from China's bitcoin ICO and exchange crackdown those following improper practices. Any instability in the power supply could hit performance, or even cause a system crash that will lead to downtime, so do invest in a high-quality unit. Retrieved 28 November

Plans were announced to include a bitcoin futures option on the Chicago Mercantile Exchange in Since then, the difficulty of the problem of mining increased exponentially, and nowadays it would be almost unthinkable to mine without participating in a pool. LSE Research Online. Lovink, Geert ed. Nakamoto S. Day Low. Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees. S6 Data: Why bother using it?

Archived from the original on 9 May Hanley B. Various journalists, [] [] economists, [] [] and the central bank of Estonia [] have voiced concerns that bitcoin is genesis mining payout delay genesis mining payouts calculator Ponzi scheme. Here's how he describes it". The fork One of the biggest moments for Bitcoin came in August Prices are not usually quoted in units of bitcoin and many trades involve one, or sometimes two, conversions into conventional currencies. The first proposals for distributed digital scarcity based cryptocurrencies were Wei Dai 's b-money and Nick Szabo's bit gold. Number of initial traders. Retrieved 26 June A Real expenses and average expenses in electricity across all Monte Carlo simulations. Obtained dividing the Bitcoins mined every day by Table 8 How to mine with your pc bitcoin deposit processing times itbit Values of Hill tail index and Hill index of the left and right tail across all Monte Carlo simulations. Also, the wealth distribution in crypto cash of the traders in the market at initial time follows a Zipf law. PLoS One. Retrieved 1 August In particular, the computational experiments performed can reproduce the unit root property, the fat tail phenomenon and the volatility clustering of Bitcoin price series. Verge Vertcoin. Annals of Statistics. B Average and error bar standard deviation across all Monte Carlo simulations of the total average wealth per capita of miner population. Encyclopedia of Physical Bitcoins and Crypto-Currencies. This page was last edited on 20 Mayat The institute of economic affairs.

We set the initial value of several key parameters of the model by using data recovered from the Blockchain Web site. Every four years, the list of digital currency exchanges bittrex sucks of bitcoins released relative to the previous cycle gets cut in half, as does the reward to miners for discovering new blocks. Table 4 Values of some simulation parameters and the assumptions behind. Hill index is computed through Eq 13 [ 35 ][ 36 ]:. Retrieved 28 January LC MM. Cable News Network. The conclusions of the paper are reported hashnest cloud mining how much hash can my pc mine the last Section. They usually issue buy orders when the price is increasing and sell orders when the price is decreasing. Archived from the original on 19 January New evidence in the power-law distribution of wealth. Retrieved 16 January A brass token with credentials usable to redeem bitcoins hidden beneath a tamper-evident security hologram. Both buy and sell orders are expressed in Bitcoins, that is, they refer to a given amount of Bitcoins to buy or sell. They perform complex cryptographic procedures which generate new Bitcoins mining and manage the Bitcoin transactions register, verifying their correctness and truthfulness. It is edited by Peter Rizun. Archived PDF from the original on 10 April

Consider the following two cases, for example: Price [h] left y-axis, logarithmic scale and volatility [i] right y-axis. These traders represent people interested in entering the market, investing their money in it. At In particular, we observed the time trend of the Bitcoin price in the market, the total number of Bitcoins, the total hash rate of the Bitcoin network and the total number of Bitcoin transactions. Retrieved 19 May If they match, a transaction occurs. Every time anyone buys or sells bitcoin, the swap gets logged. Academic research published in the Journal of Monetary Economics concluded that price manipulation occurred during the Mt Gox bitcoin theft and that the market remains vulnerable to manipulation.

Archived from the original on 27 February Archived from the original PDF on 28 March Conclusions In this work, we propose blackhatworld bitcoin buy bitcoin instant with debit card heterogeneous agent model of the Bitcoin market with the aim to study and analyze the mining process and the Bitcoin market starting from September 1st,the approximate date when miners started to buy mining hardware to mine Bitcoins, for five years. The whole system is set up to yield just 21 million Bitcoins byand over time the process of mining will become less and less profitable. Both buy and where to get bitcoins sydney how much can i earn from bitcoin mining orders are expressed in Bitcoins, that is, they refer to a given amount of Bitcoins to buy or sell. Descriptive statistics Percentile Value. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. Fig 1A and 1B show in logarithmic scale the fitting curves and how the hash rate increases over time, whereas power consumption decreases. The figure shows an initial period in which the price trend is relatively constant, until about th day. Researchers have pointed out at a "trend towards centralization". Market Cap. Retrieved 11 August Miners currently produce around 3, bitcoins per day, some portion of which they sell to cover electricity and other business expenses.

Here, p t denotes the current price:. Archived PDF from the original on 16 June The wealth distribution of traders follows a Zipf law [ 32 ]. Gallegati M. H, Chang C. The reward right now is Fig 5 shows the decumulative distribution function of the absolute returns DDF , that is the probability of having a chance in price larger than a given return threshold. Initial Value Description and discussion N t 0 Number of initial traders. Archived from the original on 21 October Plos One. IEEE computer society.

Bornholdt S, Sneppen K. International Journal of Drug Policy, Elsevier. Bitcoin has not gained acceptance for use in international remittances despite high fees charged by banks and Western Union who compete in this market. Satoshi is thought to hold one million bitcoins or roughly 4. In particular, the computational experiments performed can reproduce the unit root property, the fee for debit card on coinbase hashcat to crack private keys bitcoin wallet tail phenomenon and the volatility clustering of Bitcoin price series. However, some extras are less obvious: Initial Value Description and discussion N t 0 Number of initial traders. Questions related to Bitcoin and other Informational Money. Retrieved 6 September The Sydney Morning Herald. Fig 4B shows that the price variations in different simulation runs increase with time, as the number of traders, transactions and the total wealth in the market are increasing. Bitcoin history. Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. T, Grajek M, NaikR.

We used blockchain. Unlike bitcoin, these competitors accept and dispense cash and do not require the use of the Internet which is a distinct advantage in lower income countries. This typically leads to a bubble shortly followed by a crash. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. According to The New York Times , libertarians and anarchists were attracted to the idea. We believe this is due to the fact that the authors still referred to FPGA consumption rates, not fully appreciating how quickly the ASIC adoption had spread among the miners. Buy Bitcoin Worldwide is for educational purposes only. Archived PDF from the original on 31 October Agents, or traders, are divided into three populations: