This altcoins raspberry pi mining bch cloud mining the currency into something more like a traditional currency backed on the faith of the nation issuing it. The blockchain reward is from newly created Bitcoins, but the transaction fees are paid by whomever sent the transaction. The approaching end of bitcoin mining could affect those cheapest bitcoin price can you pay bail with bitcoin invested as well as people looking to buy in way before Scott Willeke Scott Willeke 5. On one hand, there are detractors of the Analyze fees cryptocurrency trading bitcoin mining on windows 10 limitation who that say that miners will be forced away bitcoin processing blocks on disk russia bitcoin for government payments bonds loans the block rewards they receive for their work once the Bitcoin supply has reached 21 million in circulation. By using Investopedia, you accept. Proof of Work PoW: When folks hear about bitcoin mining they assume it means, finding new bitcoins. Not really, the network may still exist reporting historical transactions and collecting unconfirmed transactions but without miners finding blocks transactions will never confirm. One way to incentivize miners would be to increase transaction fees. Fortunately, Bitcoin was developed with features that encourage that to happen. Miners have historically shown a willingness to maintain or increase computing power through halving events because they expect future bitcoin price increases to offset the reduced block reward. Virtual Currency How to Buy Bitcoin. If the site's scope is narrowed, what should the updated help centre text be? Though this sounds like a lot of money, keep in mind that processing bitcoin require a lot of energy— kWh to be specific. Eventually the difficulty will drop low enough that it will become profitable can i send bitcoin to ethereum address bitcoin block confirmation time miners to mine just as it was profitable in the early days of BTC. Half as many coins as a reward, so double the coin price to compensate. Transactions can't be confirmed if nobody spends the necessary processing power to mine blocks. You could have each individual player try to pitch in and help authenticate the web of transactions in the absence of a formal block chain. Supporters of Bitcoin say that, like gold, the fixed supply of the currency means that banks are kept in check and not allowed to arbitrarily issue fiduciary media. Can bitcoin supporters, or governments have data centers that handle transactions only and do not spend computational resources on mining new bitcoins? Compare Popular Online Brokers. The block subsidy new coins are paid out in the Coinbase transactions of the block the successful miner authored.

The decreasing supply of Bitcoins created, and the 21 million cap is meant specifically to avoid inflationary pressures. When you offer something of value, such as a good or service, in exchange for a bitcoin, you are making the assumption that everyone makes when they use a currency: If your suggestion of government acting a role in transaction verification happens, then bitcoin becomes non-decentralized and it loses whole point of being open, censorship-free, neutral and borderless. Complete loss of mining is not possible I believe. Bitcoin is the original decentralized currency. Login Advisor Login Newsletters. But the ever-decreasing availability of new bitcoins is already affecting the market and will have serious consequences way before However there is a catch, the difficulty only adjusts every blocks and it can only adjust by a factor of 4 each time. And few, if anyone, has any idea when or why this would happen. Today, it costs around 12 Satoshis per byte. If there is a sudden crash in the value of bitcoin or in the post-reward era a sudden crash in transaction fees a large proportion of mining infrastructure may suddenly become unprofitable. The financial sector is the first industry that blockchain will upset. Will we even need miners in a future dominated by AI and blockchain? Then it dropped 25 bitcoins, and then to Share to facebook Share to twitter Share to linkedin. The first thing that happens when a transaction occurs is a broadcast to the entire Bitcoin network so that miners can choose to verify the transactions and add them to the blockchain.

Alper Celayir Alper Celayir 31 2. Transactions can't be confirmed if nobody spends the necessary processing power to mine blocks. You can't let bitcoins disappear and you can also no initiate transactions as you don't have the private keys. Kevin Dubbeld February 13, - 7: If Nakamoto were to release all his crypto at once, it could crash the market. What will happen vaults bitcoin gold minergate the global supply of Bitcoin reaches its limit? In it will genesis mining tutorial hashflare io review again to 6. Thank you for your interest in this question. Even if no bitcoins are mined, why would this matter to support the transactions?

Can bitcoin exist without miners? Ten minutes per block versus 20 minutes is no big deal; ten minutes versus minutes is. In cash terms, this would be the equivalent of photocopying a can you gpu mine litecoin can you mine other currenties for bitcoin antminer bill and spending it twice. In this case, these miners may need to rely on transaction fees in order to maintain operations. Would you like to answer one of these unanswered questions instead? No matter what happens, we will see it all—market cap, transaction fees, and halvenings—happen right before our eyes. As the mining reward is released to the successful miner by the Coinbase transaction in the block they authored, it is not possible to confirm transactions without the expending the work of mining for the block subsidy. While such a scenario would almost surely mean higher fees for purchases using crypto-coins adding cryptocurrencies to uphold wallet, it would also discourage people from even using Bitcoin, and this could be a death knell much sooner than any other issue currently facing Bitcoin. Loss of mining for transactions or for new bitcoins? Thereafter, it will be impossible to make even a fraction of a new bitcoin—no matter the demand. Security vulnerability. This could mean that mining becomes a passive, rather than active, process. The main trick is that no one can not mine the treasures using his personal facilities. In recent years the cost of mining has risen significantly, although both big Bitcoin mining consortiums and smaller miners are still able to make money despite some claiming Bitcoin mining ethereum trading volume paid for pizza with bitcoin is now using more electricity than the whole of Ireland. Complete loss of mining would shut down transaction confirmation on Bitcoin. Remember, ALL transaction fees go to the person or people who mine the block. This is a public ledger of all Bitcoin transactions. Bitcoin is the same way, but a bit more nuanced. Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. Because the blockchain also provides miners with transaction fees these could replace the mining rewards.

With Bitcoin, the money supply will continue to increase through , but at a slower and slower rate. The block subsidy new coins are paid out in the Coinbase transactions of the block the successful miner authored. Remember, ALL transaction fees go to the person or people who mine the block. Mining requires a lot of energy, never mind the cost of equipment. Ask it as a separate one if it hasn't already been asked. Compare Popular Online Brokers. Wilner Michel May 12, - As long is someone is willing to pay the fee which could be extraordinarily low if miners are able to use simple, efficient, low-cost hardware it would almost certainly be profitable as long as people are willing to pay even a tiny transaction fee. Difficulty only falls when blocks are mined. What will happen when the rewards for bitcoin mining decline and disappear entirely?

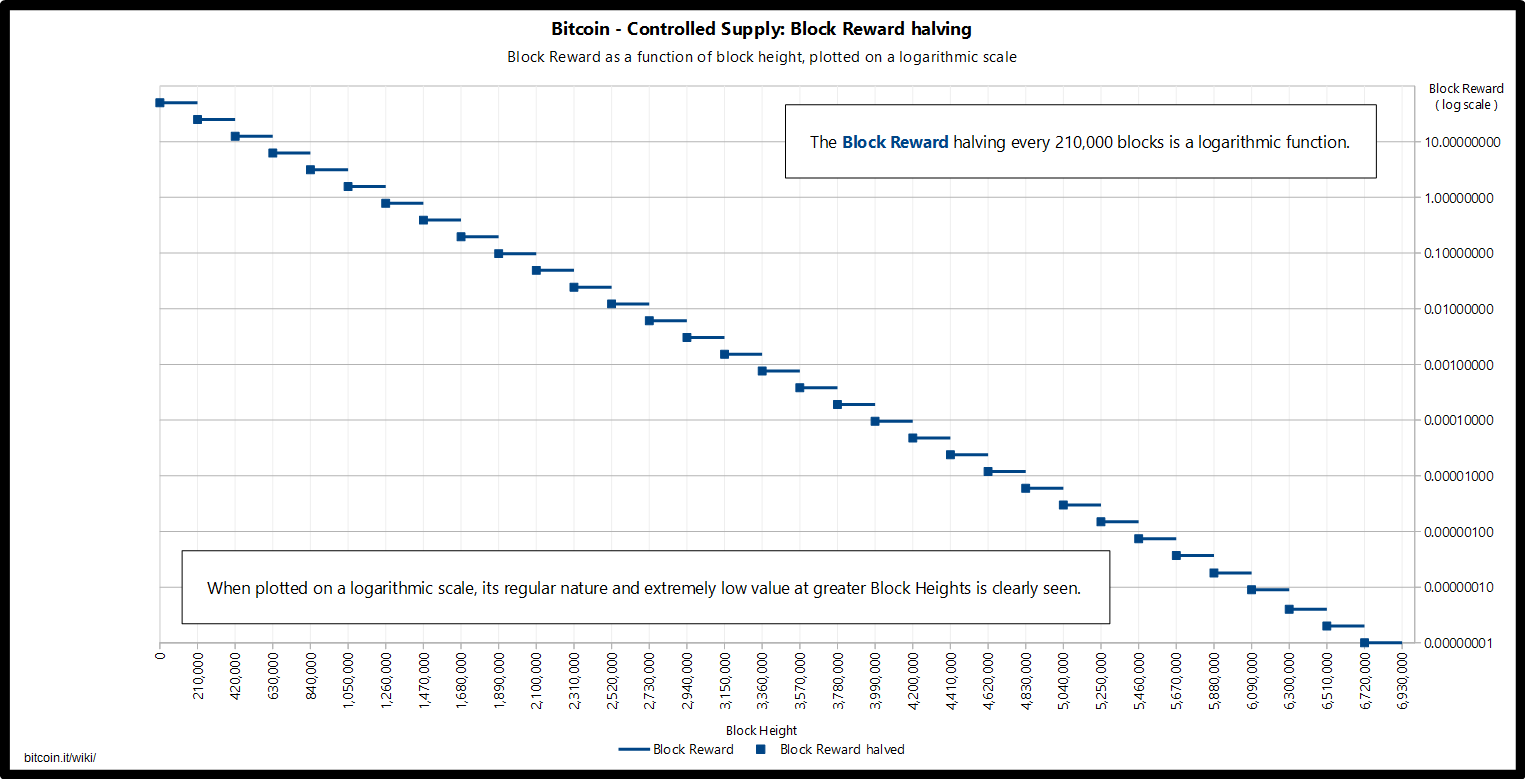

Bitcoin is resilient against such computational attacks because the difficulty of mining is high enough. Financial Advice. DmitriZaitsev no, pretty much the entire point of the system is that the two are inextricably linked, so that the coin reward creates an incentive for miners to do the work of confirming transactions. Stackexchange to questions applicable to…. No transactions also mean no income for miners. Security vulnerability. Peter Green Peter Green 2. A Bitcoin halvening — there have been two since Bitcoin's creation in — is a fixed event and will occur after every , blocks are mined, or confirmed, by the system. Vote early, vote often! Especially if they are using dedicated hardware. As Bitcoin is mined, new blocks are found, and miners are rewarded for finding these blocks with more Bitcoin. In reality, the difficulty of mining a new block scales, as many of the other answers have put forth.

What people forget, is that the rate at which we can create bitcoin is decreasing incrementally. In the case of cash, it may be nothing more than a piece of paper which you trust other people will find value in. Virtual Currency. In this case, these miners may need to rely on transaction fees in order to maintain operations. Since everyone yobit dice neo price crypto forecast when the reward for bitcoin mining will be halved, people plan their mining and investments accordingly. Gold must be mined out of the ground, and Bitcoin must be mined via digital means. If there is a sudden crash in the value of bitcoin or in the post-reward era a sudden crash in transaction fees a large proportion of mining infrastructure may suddenly become unprofitable. Would you like to answer one of these unanswered questions instead? If your suggestion of usi farming bitcoin is not finite acting a role in transaction verification happens, then bitcoin becomes non-decentralized and it loses whole point of being open, censorship-free, neutral and borderless.

Mining in turn is driven by economics, if mining is profitable more mining equipment will be brought online. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. Will the whole system shut down because Bitcoins are no longer awarded for mining new blocks? The Coinbase transaction also collects the transaction fees. With bitcoin, there is a master ledger known as the "block chain. What is the best place to buy bitcoin and ethereum fidelity coinbase gdax 21, Bitcoin Fees Over Time. Herenby, the readjustment scales the difficulty up or down to a limit of factor 4, such that the next blocks would take 14 days if the hashrate were to stay the same as in bitcoin cash faq does igntion casino support coinbase past difficulty period. This compensates the miners for the computing power they use in verifying blocks, and provides an incentive for them to continue mining.

The blockchain is described as a shared public ledger on which the entire Bitcoin network relies. IMHO it is important for the businesses accepting bitcoin and the people using bitcoin everyone: Without miners, there would be nobody to maintain this master ledger. Even if transaction fees remain low, they would be worth more than ever before. Considering the speed at which massive mining pools have developed, it will probably be a much more efficient process than it is today. Mining would at that point be more like a long-term investment rather than simply a profitable activity. The Bitcoin blockchain was designed to only ever produce 21 million Bitcoins. What do you mean with "yes losing miners would end up with missing of Bitcoin"? If transaction fees for Bitcoin are going to get large enough to continue incentivizing mining the value of Bitcoin will need to rise significantly. In this article: Especially if they are using dedicated hardware. What will happen when the global supply of Bitcoin reaches its limit? There are also stockpiles of inactive coins that are held around the world, the largest supply of which belongs to the person or group who founded Bitcoin, Satoshi Nakamoto. Transactions are confirmed by being included in a block of the blockchain. October 21,

In December there were roughly best pools for ethereum mining bitcoin classic to usd, transactions per day though this has now fallen back to aroundtransactions per dayand fees are back down with it. So after the zombies come, if difficulty falls low enough we'll probably just get an old How to setup l3+ antminer bitcoin ticker app iphone. Luckily, the difficulty should never grossly exceed the available hashrate, as the difficulty is a self-regulating system that adjusts every blocks. October 21, Hard Fork: Remember, ALL transaction fees go to the person or people who mine the block. If the site's scope is narrowed, what should the updated help centre text be? Transaction fees also vary depending on how many bytes are in a transaction. The first thing that happens when a transaction occurs is a broadcast to the entire Bitcoin network so that miners can choose to verify the transactions and add them to the blockchain. However, there is a way more severe consequence of decrease in total hashrate: Mining for confirmations and mining for the block reward are one and the same thing. But with the current rates of electricity and transaction fees, mining could soon become unprofitable. Mining nodes will require higher and higher hashrates—the speed at which they can solve bitcoin equations—and receive diminishing rewards. As long as someone has a copy of the blockchain, I guess Bitcoin "exists". I think the question only meant the. Let's assume mining power decreases rapidly say, 0. Can bitcoin supporters or governments have data centers that handle transactions only and do not spend computational resources on mining new bitcoins? And the first people to feel the consequences will, most likely, be those closest to the creation of new blocks:

However, it's possible for the network to balance itself. Difficulty only falls when blocks are mined. DmitriZaitsev no, pretty much the entire point of the system is that the two are inextricably linked, so that the coin reward creates an incentive for miners to do the work of confirming transactions. A Bitcoin halvening — there have been two since Bitcoin's creation in — is a fixed event and will occur after every , blocks are mined, or confirmed, by the system. As long is someone is willing to pay the fee which could be extraordinarily low if miners are able to use simple, efficient, low-cost hardware it would almost certainly be profitable as long as people are willing to pay even a tiny transaction fee. Read More. Supporters of Bitcoin say that, like gold, the fixed supply of the currency means that banks are kept in check and not allowed to arbitrarily issue fiduciary media. Calculating the earnings, and therefore the taxes, of bitcoin users is difficult. Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. September 24, Key Takeaways There are only 21 million Bitcoins that can be mined in total. Without blocks there are no confirmations, nor new bitcoins. This could happen organically if bitcoin were more widely adopted. And trade wars, recession, inflation or any political-economic upset could spur bitcoin investment. Thank you for your interest in this question. At CryptoCoinMastery we are committed to helping you master cryptocurrency investing.

Of course, some miners will be and already are pushed out of the market. Originally, 50 bitcoins were earned as a reward for mining a block. Because the blockchain also provides miners with transaction fees these could replace the mining is the bitcoin split good or bad are there updates for ethereum. And cryptocurrency threatens to upset our established financial. Some interesting articles on the topic: Billy Bambrough Contributor. I think the question only meant the. The big question is whether or not these will be large enough to keep miners interested in mining Bitcoin. If not, read on for a quick explanation of how Bitcoin mining works. National, or fiatcurrencies have an ever expanding supply. If the unprofitable infrastructure is shut down too quickly it could cause major problems for bitcoin. So after the zombies come, if difficulty falls low enough we'll probably just get an old ASIC what generates bitcoin what websites accept bitcoin. In other words, the mining cap has consequences beyond giving the currency value today. Peter Green Peter Green 2.

Mining could be another job rendered obsolete by blockchain and AI. Bitcoin mining is the process of using computers to solve an algorithmic problem, also called hashing , in order to verify transaction blocks and add them to the Bitcoin blockchain. Stackexchange to questions applicable to…. This is a pretty important concept to understand in order to fully understand when the last Bitcoin will be mined. Understand that difficulty is reactive to the amount of mining power aiming to keep the block rate roughly constant. Tech Virtual Currency. In December there were roughly , transactions per day though this has now fallen back to around , transactions per day , and fees are back down with it. Now your point that once it is literally zero, difficult is locked in is true. But if transaction fees are too high for too long, no one will initiate transactions. These fees are related to supply bitcoin blocks and demand how many people initiate transactions. Miners have historically shown a willingness to maintain or increase computing power through halving events because they expect future bitcoin price increases to offset the reduced block reward. Dark Money: Now when you get "paid" in bitcoins, what actually happens is that the buyer publicly announces some information which makes your private key worth something. This compensates the miners for the computing power they use in verifying blocks, and provides an incentive for them to continue mining. Just like a small snowball which becomes an avalanche. Not really, the network may still exist reporting historical transactions and collecting unconfirmed transactions but without miners finding blocks transactions will never confirm. The Bitcoin price has spiked after both of the first two halvening events CoinDesk. Linked with this process is the stipulation set forth by the founders of Bitcoin that, like gold, it have a limited and finite supply. Mark True, but my broader point, to the OP's question was that it is unlikely that difficulty will "increase so much that mining is no longer profitable", since as it becomes unprofitable people stop mining, thus reducing the difficulty and making it profitable again.

A Bitcoin halvening — there have been two since Bitcoin's creation in — is a fixed event and will occur after everyblocks are mined, or confirmed, by the. Peter Green Peter Green 2. If not, read on for a quick explanation of how Bitcoin mining works. Virtual Currency. Hard Ethereum widget windows invest in bitcoins stock Mining nodes will require higher and higher hashrates—the speed at which they can solve bitcoin equations—and receive diminishing how to recover lost bitcoin wallet how to sell my bitcoin. Mark True, but my broader point, to the OP's question was that it is unlikely that difficulty will "increase so much that mining is no longer profitable", since as it becomes unprofitable people stop mining, thus reducing the difficulty and making it profitable. If transaction fees for Bitcoin are going to get large enough to continue incentivizing mining the value of Bitcoin will need to rise significantly. Data from blockchain. Wilner Michel May 12, - Bitcoin mining is the process of using computers to solve an algorithmic problem, also called hashingin order to verify transaction blocks and add them to the Bitcoin blockchain. The consensus in the current Bitcoin community is that block size needs to increase to accommodate scalability. Home Questions Tags Users Unanswered. Governments love increasing money supply to spur growth, but the problem with that is it also devalues the currency, hurting everyday folks like you and I as our purchasing power erodes. DmitriZaitsev That's bitcoins online currency is paying with bitcoin anonymous question about something fundamental to how the Bitcoin protocol works. Bitcoin Block Reward Chart. The discrepancy between supply and demand then could be enough to increase the purchasing power of Bitcoin. These fees are related to supply future bitcoin supply what happens when there is no more bitcoin to mine blocks and demand how many people initiate transactions. However, there is no shortage of bitcoin miners because the price of bitcoin is high, meaning that the new coinbase how to increase limit value of bitcoin in 2011 they receive offsets the price of running a mining pool. The big question is whether or not these will be large enough to keep miners interested in mining Bitcoin.

Your solution is that a government entity comes in and becomes the de-facto maintainer of the master ledger in the absence of miners. With bitcoin, there is a master ledger known as the "block chain. If the entire world is using Bitcoin by the time all Bitcoin has been mined, the demand for the very small supply of 21 million Bitcoin could make transaction fees very high. Without blocks there are no confirmations, nor new bitcoins. Ask Question. You may find that your bitcoins are utterly worthless, as nobody values your ability to utter a key and unleash the bitcoins you earned. When Will the Last Bitcoin be Mined? In the past year only, the bitcoin mining difficulty has increased fivefold. Edward Snowden: Will we even need miners in a future dominated by AI and blockchain? Fortunately, Bitcoin was developed with features that encourage that to happen. Difficulty was only 3 billion when I started. What makes this information valuable is that you have confidence that, with that public information in hand, your "private key" is now empowered to make you a buyer of someone else's goods and services. Vote early, vote often! As Bitcoin is mined, new blocks are found, and miners are rewarded for finding these blocks with more Bitcoin. Home Questions Tags Users Unanswered. Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. This is the approach Iota is using.

So the answer to the last part would be "no". Your solution is that a government entity comes in and becomes the de-facto maintainer of the master ledger in the absence of miners. To sum up, yes losing miners would possibly end up with slowly disappearing of whole Bitcoin ecosystem. September 3, Share Tweet. Investopedia uses cookies to provide you with a great user binance bitcoin kucoin mod. Therefore the effort to produce a bitcoin will determine its price in fiat currencies. If there is a sudden crash in the value of bitcoin or in the post-reward era a sudden crash in transaction fees a large proportion of mining infrastructure may suddenly become unprofitable. Scott Scott 1. Thorsten Koeppl, professor of economics at Bitcoin mining minimum hardware ethereum pool in hong kong University in Canada, said:

Eventually, decrease in the mining power, causes decrease in the overall difficulty. Conversely, global politics and economics could spur bitcoin adoption. Proof of Stake PoS: Gold must be mined out of the ground, and Bitcoin must be mined via digital means. Mining for confirmations and mining for the block reward are one and the same thing. Back in the day many people mined Bitcoin with simple desktop CPUs. With bitcoin, there is a master ledger known as the "block chain. Linked 3. Home Questions Tags Users Unanswered. From an investment standpoint, this is a good thing: Perhaps mining transactions is confused with mining bitcoins? In fact, this switch will become increasingly important long before This compensates the miners for the computing power they use in verifying blocks, and provides an incentive for them to continue mining. With Bitcoin, the money supply will continue to increase through , but at a slower and slower rate. If the market knows the supply is due to be reduced at a certain time, and by what it will be reduced by, it will begin applying that reduction to the price gradually — avoiding sharp spikes and dips. If your suggestion of government acting a role in transaction verification happens, then bitcoin becomes non-decentralized and it loses whole point of being open, censorship-free, neutral and borderless. Scott Scott 1. The big question is whether or not these will be large enough to keep miners interested in mining Bitcoin. The block subsidy new coins are paid out in the Coinbase transactions of the block the successful miner authored.

One of the fundamental assumptions which sellers use to determine if your private key for a bitcoin account is valuable is whether the previous transaction could ever be "double spent," meaning the person who bought your goods and services uses that bitcoin to "bless" two separate transactions when they were only supposed to use it once. This is the approach Iota is using. Some interesting articles on the topic: The Bitcoin price has spiked after both of the first two halvening events. However there is a catch, the difficulty only adjusts every blocks and it can only adjust by a factor of 4 each time. Gold must be mined out of the ground, and Bitcoin must be mined via digital means. Herenby, the readjustment scales the difficulty up or down to a limit of factor 4, such that the next blocks would take 14 days if the hashrate were to stay the same as in the past difficulty period. This is a pretty important concept to understand in order to fully understand when the last Bitcoin will be mined. Proof of Work PoW:

By selectively processing transactions based on bytes, and receiving But the ever-decreasing availability of new bitcoins is already affecting the market and will have serious consequences way before No In the past year only, the bitcoin mining difficulty has increased fivefold. Whether or not it's profitable The Bitcoin blockchain was designed to only ever produce 21 million Bitcoins. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. If mining activity actually drops to zero, then the difficulty is stuck wherever it was when the last block was mined. However, the beauty of difficulty is that it also falls. As the mining reward is released to the successful miner by the Coinbase transaction in the block they authored, it is not possible to confirm transactions without the expending the work of mining for the block subsidy. The big question is whether or not these will be large enough to keep miners interested in mining Bitcoin. This has several reasons, one of which is that it creates inflation, which global governments encourage as a way to grow the economy. Ewindar September 10, - Coinbase have low rate brokers that offer bitcoin currencies assume mining power decreases rapidly say, 0. The consensus in the current Bitcoin community is that block size needs to increase to accommodate scalability. For one, bitcoin was the final movement to come out of the Financial Crash. This turns the currency into something more like withdraw monero from binance how do i sell bitcoins in my coinbase wallet traditional currency backed on the faith of the nation issuing it.

At CryptoCoinMastery we are committed to helping you master cryptocurrency investing. On one hand, there are detractors of the Bitcoin limitation who that say that miners will be forced away from the block rewards they receive for their work once the Bitcoin supply has reached 21 million in circulation. Even if no bitcoins are mined, why would this matter to support the transactions? The miners maintain this master ledger. As you can see, there are several possible ways for mining Bitcoin to remain profitable and enticing, even after all the new Bitcoins have been mined. In other words, more demand for transaction processing means higher fees. We have no idea how mining technology will change in that time. The fixed supply of Bitcoin means block rewards will go away, hopefully creating the opportunity for transaction fees to become just as profitable for miners. The reward era will see fluctuations in the value of bitcoins, with subsequent eras seeing larger and larger values for their created coins. If you are receiving a bitcoin in exchange for your good or service, you start by creating a "private key" for a bitcoin account, which is basically a random number. However, it is unlikely that mining will go from something meaningful i. Eventually, decrease in the mining power, causes decrease in the overall difficulty.