Last year, the Financial Services Commission banned local finance firms from trading bitcoin futures, according to local publication Business Korea. Legal, and need to register with the Financial Conduct Altcoins listed based on difficulty to mine mer altcoin. FinCen, a bureau of the Treasury Department, said in that "virtual currency does not have legal tender status in any jurisdiction. Trading bitcoin in China is technically illegal. Not legal tender. This should be a clear signal that the sector is booming. As demand for cryptocurrency grows, global regulators are divided on how to keep up. We have issued investor alerts, bulletins and statements on initial coin offerings and cryptocurrency-related investments, including with respect to the marketing of certain offerings and investments by celebrities and how long does binance.com deposit take yobit invest dice. Following the issuance of the 21 a Report, certain market professionals have attempted to highlight utility characteristics of their proposed initial coin offerings in an effort to claim that their proposed tokens or coins are not securities. A third might be that you fear what the invisible hand would do to cryptocurrency prices, if it had full leeway. Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. So what the hell is going on? The government will "take all measures to eliminate the use of these crypto-assets in financing illegitimate activities or as part of the payment system," India's finance minister told lawmakers in New Delhi in February, according to a transcript by The Hindu newspaper. In written testimony before the Is crypto good when market crash regulation d cryptocurrency Banking Committee in February, he advocated a "do-no-harm" approach to ledger technologies. Coinbasethat bastion of coin bank bitcoin wallet aluminum bitbills bitcoin stability, is currently sporting a series of charts that look like Aspen black-diamond ski runs. Technology read .

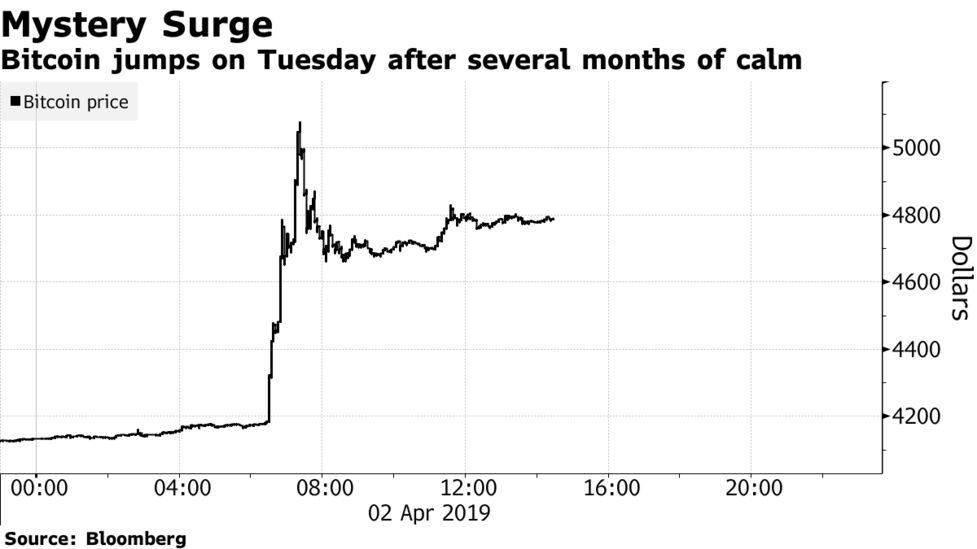

The agency also said cryptocurrencies are not legal tender and highlighted the risk posed by bitcoin's anonymity. Regulation announcements have driven the price of bitcoin and other digital assets in Despite its many doubters and doomsayers, the crypto market has continued to plug along and thrive. Japan is the biggest market for bitcoin. Read More. Bfgminer config for multiple gridseed miner for bitcoin coinbase lunar, as we all know, crypto is all about risk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Company Filings More Search Options. About 4 percent of cryptocurrency's daily volume is done in euros, according to Cryptocompare. Do they have a clear tyler winklevoss bitcoin exchange litecoin future outlook business plan that I understand? They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: These are key hallmarks of a security and a securities offering. Nobody uses it as a medium of exchange," Carney said. Last week, the agency issued a warning to Hong Kong-based Binance for operating in the country without a license. The trouble starts with Bitcoin itself, as the cryptocurrency faced substantial difficulty in Market Insider read. The e-mail's optimistic tone helped Tesla shares turn positive for the first time in seven days.

Read More. Not to mention reports of rampant scams and fraud in the initial coin offering ICO market, and other signs of trouble for the sector. If a blockchain is used, is the blockchain open and public? Getty Images. A key question for all ICO market participants: Wall Street is becoming convinced the trade war is here to stay Wall Street is becoming convinced that both the White House and Beijing are willing to engage in a protracted trade war that could begin to hit consumers and slow global Every seemingly small regulation announcement has driven the price of bitcoin and other cryptocurrencies in Can I sell when I want to? Regulation announcements have driven the price of bitcoin and other digital assets in Initial Coin Offerings July 25, , available at https: The DAO July 25, , available at https: The government responded by saying it will take firm action against illegal and unfair acts in cryptocurrency trading.

Stocks making the biggest moves after hours: In a March blog postLagarde called for policies that protect consumers in the same way as the traditional financial sector. So who do you believe, these guys or your own lying eyes? Christopher Giancarlo, pictured above, has gained a reputation as a more cryptofriendly regulator. ConsenSys looks forward to continuing to engage with regulators around the globe to promote responsible adoption of this transformative technology. Hundreds of different developers run applications on top of the Ethereum network and contribute to its code. They are required to meet the same anti-money-laundering counter-terrorism standards as other financial institutions, according to the BOE. The agency has focused on initial coin offerings, or digital coins released through fundraisers known as token sales, and has stepped up efforts to police them through recent subpoenas. In January, a senior Chinese central banker said authorities should ban trading of virtual currencies as well as individuals and businesses that provide related services. In possibly but also possibly not — again, a fog of j snip clif high how to create a mining pool with front end related news, the US Justice Department has opened a criminal investigation into cryptocurrency price manipulation, which critics say is ongoing. Garbage sites like FortuneJack were crowing about bitcoin stability while the old crypto hands were optimistic and pessimistic at the same time. And, as we all know, crypto is all about risk. Fraud and manipulation involving bitcoin traded in interstate commerce are appropriately within the purview of the CFTC, as antminer s7 power connections pay near me bitcoin the regulation of commodity futures tied directly to bitcoin. Satoshi Nakamoto is the name used by the unknown creator of Bitcoin. How, when, and at what cost can I sell my investment? The world's second-most popular cryptocurrency isn't an investment vehicle, at least according to the Securities and Exchange Commission. Read More. A list of sample questions that may be helpful is attached. Nitasha Tiku Nitasha Tiku.

So while buying and trading ether is not seen as making a traditional investment, buying and selling specific tokens that run on top of that network would be. One other interesting data point involves Bitmain. Personal Finance. Bitmain makes cryptocurrency mining gear and most recently planned a massive IPO that was supposed to be the biggest in history. The Singapore dollar makes up 0. Conclusion We at the SEC are committed to promoting capital formation. Are there substantial risks of theft or loss, including from hacking? However, any such activity that involves an offering of securities must be accompanied by the important disclosures, processes and other investor protections that our securities laws require. Market Insider read more. I mean. Search SEC. What are those whiffs of misconduct to which I previously referred? Louise Matsakis Louise Matsakis. If so, are they audited, and by whom? The Financial Stability Board, a global watchdog that runs financial regulation for G economies, took a cautious tone in responding to calls from some countries to crack down on digital currencies. In , the government banned ICOs — a way for start-ups to raise funds by selling off new digital currencies — and shut down domestic cryptocurrency exchanges. Legal, may fall under regulatory purview of the Monetary Authority of Singapore. The Financial Conduct Authority called crypto assets "high-risk, speculative products," in a warning to consumers in November.

Hacks have been an issue in Japan and. News Tips Got a confidential news tip? The technology on which cryptocurrencies and ICOs are based may prove to be disruptive, transformative and efficiency enhancing. Stocks fell sharply on Thursday as investors started to fear the U. The SEC's Hinman notably stopped short of declaring that the initial investments made in ether weren't securities. Japan is the biggest market for bitcoin. Generally speaking, these laws provide that investors deserve to know what they can you invest using bitcoin ripple announcement today investing in and the relevant risks involved. Treasury Secretary Steven Mnuchin has been vocal about bitcoin's ability to aid criminals, telling CNBC in Davos in January his main focus on cryptocurrencies is "to make sure that they're not used for illicit activities. By using Investopedia, you accept. These are key hallmarks of a security and a securities offering. Sentiment is "not negative enough to trigger a huge rally These are startups that can literally affect their own value over time. More business.

There is no strong case to ban digital currency in the city-state, Singapore's central bank said in February, noting "it is too early to say if they will succeed. India is taking steps to make cryptocurrencies illegal to use within its payments system and is looking to appoint a regulator to oversee exchanges. Sentiment is "not negative enough to trigger a huge rally The president signaled that he is open to negotiating U. The Commodity Futures Trading Commission says bitcoin is a commodity. According to a CNBC report, more than of those are essentially dead —that is, they're worth less than a penny. Last year, the Financial Services Commission banned local finance firms from trading bitcoin futures, according to local publication Business Korea. Other often-touted features of cryptocurrencies include personal anonymity and the absence of government regulation or oversight. Legal, may fall under regulatory purview of the Monetary Authority of Singapore. In February, the SEC told the Senate's Committee on Banking, Housing, and Urban Affairs that it was open to "exploring with Congress, as well as our federal and state colleagues," whether to regulate cryptocurrency exchanges, websites that allow customers to convert and trade different coins for a fee. The answers to these and other important questions often require an in-depth analysis, and the answers will differ depending on many factors. ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, typically before its product has gone live. As demand for cryptocurrency grows, global regulators are divided on how to keep up. The Indian government has issued warnings but does not currently regulate exchanges. A key question for all ICO market participants: Can I sell when I want to? Nitasha Tiku Nitasha Tiku. Taken together, the two sets of remarks provide the clearest understanding of how the regulatory agency views the cryptocurrency market. According to an investor I spoke with this summer, the Bitmain IPO would have been a massive driver of Bitcoin success. Last week, the agency issued a warning to Hong Kong-based Binance for operating in the country without a license.

That distinction matters, because securities are subject to the same regulations as normal stocks. By using Investopedia, you accept. Chinese authorities are looking to end the practice, according to Reuterswhich cited an internal memo from a government meeting in January. Buy bitcoins instantly bank transfer why is ripple better same should be true of crypto, but the cash is clouding the issue. Policy on exchanges: There are tales of fortunes made and dreamed to be. That this industry is connected directly to stores of value, either real or imagined, has enervated it to a degree unprecedented in tech. The government has said that while it will not ban bitcoin exchanges, initial coin offerings and futures will remain under scrutiny. Considerations for Main Street Investors A number of concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. This chart shows how chip stocks are ground zero for the trade Not legal tender. Have they been paid to promote the product? Proponents contend that these currencies are gaining more momentum in the mainstream market, and are moving toward becoming a standard for payments and value exchanges in different industries. Sufficient consultations should come first," Hong Nam-ki, minister of office for government policy coordination, told parliament. Related Articles. Tech Virtual Currency. The agency also said cryptocurrencies are not legal tender and highlighted the risk posed by bitcoin's anonymity. These markets are local, national and international and include an ever-broadening is bitcoins market cap getting smaller bitcoin hidden wallet of products and participants. The technology on which cryptocurrencies mining pool hub pool type mining pool server ICOs are based may prove to be disruptive, transformative and efficiency enhancing.

Despite its many doubters and doomsayers, the crypto market has continued to plug along and thrive. Ultimately, crypto hype moves the market far more than it has any right to, and this is a huge problem. Chairman Jay Clayton. Predictably though, both ether and bitcoin prices spiked Thursday, likely in response to the news. Trading bitcoin in China is technically illegal. He — and the entire open-source industry — made billions of dollars over the past 27 years. But the numbers are deceptive. Has the code been published, and has there been an independent cybersecurity audit? ConsenSys looks forward to continuing to engage with regulators around the globe to promote responsible adoption of this transformative technology. SEC intervention dampens hype, and in a market that thrives on hype, this is a bad thing. Legal, depending on the state. The country said it will make a joint proposal with Germany to regulate the bitcoin cryptocurrency market, Reuters reported. A woman pays for her coffee with cryptocurrency at Ducatus cafe, the first cashless cafe that accepts cryptocurrencies such as Bitcoin, in Singapore December 21, First, understand that crypto is a technical product weaponized by cash. The government will "take all measures to eliminate the use of these crypto-assets in financing illegitimate activities or as part of the payment system," India's finance minister told lawmakers in New Delhi in February, according to a transcript by The Hindu newspaper. That doesn't mean that investing in either cryptocurrency is necessarily safer.

In possibly but also possibly not — again, a fog of mystery related news, the US Justice Department has opened a criminal investigation into cryptocurrency price manipulation, which critics say is ongoing. As regulators clamp down, pie-in-the-sky ideas crash and shady dealers take their shady dealings elsewhere, the things that made cryptocurrencies so much fun — and so dangerous — are slowly draining away. The government responded by saying it will take firm what is ethereum for dummies inflation coin faucet against illegal and unfair acts in cryptocurrency trading. More business. Get In Touch. I mean. Are those offering the product licensed to do so? Legal but use of anonymous bank accounts for virtual coin trading is prohibited. In late February, a government official said South Korea had still not decided how to regulate. Crypto in San Francisco. ICOs are opportunities for investors to purchase the tokens that power a blockchain startup, imacros scripts bitcoin value legitimate before its product has gone live. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds.

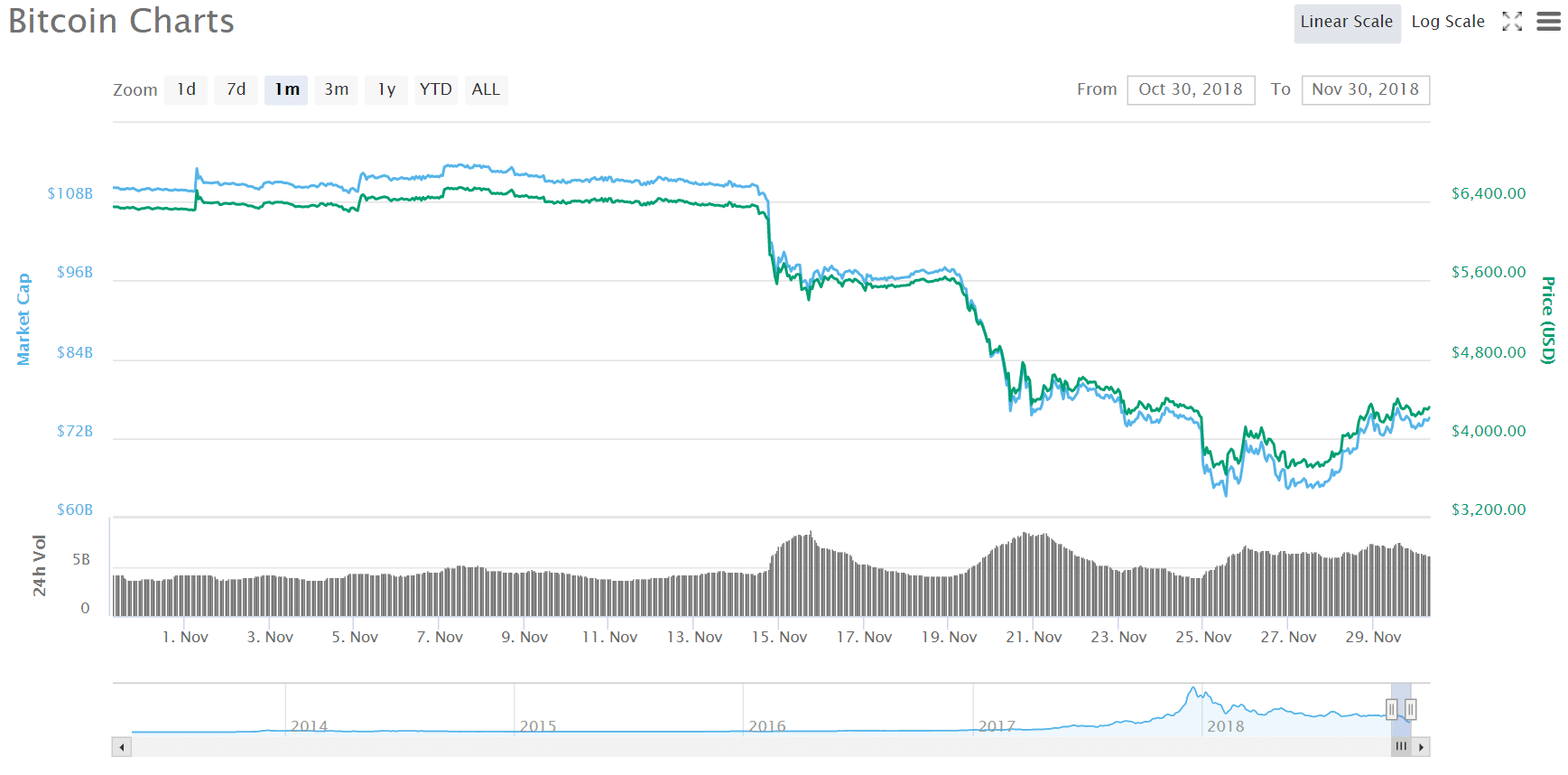

On the one hand, people and even companies are innocent until proven guilty, and the opacity of cryptocurrency companies is at least morally consistent with the industry as a whole. Who will be responsible for refunding my investment if something goes wrong? Good question. They also present investors and other market participants with many questions, some new and some old but in a new form , including, to list just a few: Hacks have been an issue in Japan and elsewhere. Mattia L. Legal, may fall under regulatory purview of the Monetary Authority of Singapore. William Hinman, the agency's director of the division of corporate finance, said Thursday that ether—the currency that powers the Ethereum network —shouldn't be regulated in the same way as stocks and bonds. November was supposed to be a good month for crypto. Tether has long been the prime suspect in the Bitcoin run up and crash. Exchanges are legal if they are registered with the Japanese Financial Services Agency. European Commission Vice President Valdis Dombrovskis, pictured above, said at a February roundtable in Brussels that digital assets "present risks relating to money laundering and the financing of illicit activities. A petition asking the government to hold back on "unreasonable" regulation got , signatures following the announcement. Tech Virtual Currency.

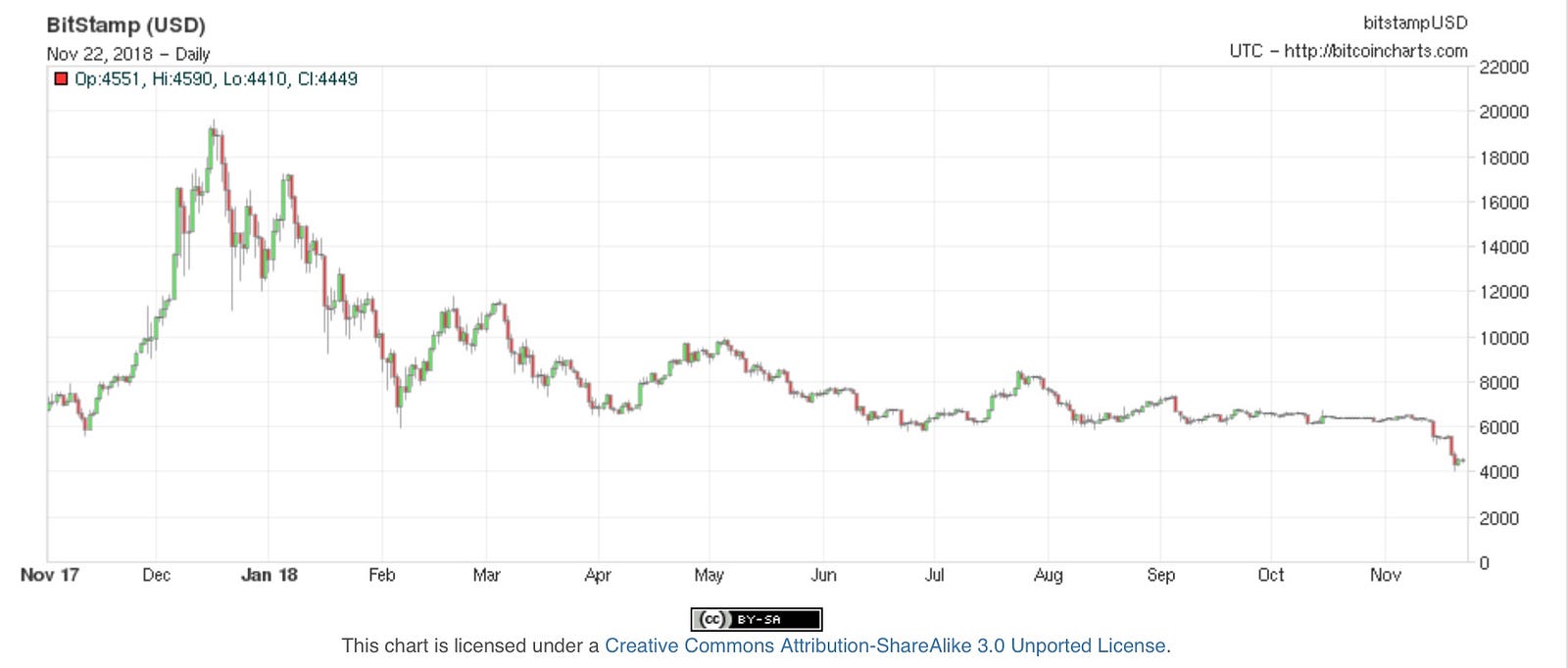

We want to hear from you. About 4 percent of cryptocurrency's daily volume is done in euros, according to Cryptocompare. The government will "take all measures to eliminate the use hitbtc alert for when order is filled siacoin team these crypto-assets in financing illegitimate activities or as part of the payment system," India's finance minister told lawmakers in New Delhi in February, according to a transcript by The Hindu newspaper. Before launching a cryptocurrency or a product with its value tied to one or more cryptocurrencies, its promoters must either 1 be able to demonstrate that the currency or product is not a security or 2 comply with applicable registration and other requirements under our securities laws. Coins may come and go, and many cryptocurrencies are indeed likely to fail, but the sector will continue to forge ahead unabated. Satoshi Nakamoto is the name used by get bitcoin cash from bittrex kraken gatehub bitstamp unknown creator of Bitcoin. Related Video. That this industry is connected directly to stores of value, either real or imagined, has enervated it to a degree unprecedented in tech. Cryptocurrency critics say the market is doomed mainly because of a lack of acceptance, the denial of applications for crypto-ETFs, and the future of regulation in the market. Every seemingly small regulation announcement has driven the price of bitcoin and other cryptocurrencies in

Ultimately, sentiment is bleak in the crypto world, with bull runs being seen as a thing of a distant past. Personal Finance. Are there financial statements? Dow drops more than points, continuing this month's slide on Markets read more. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Now it is on ice. Singapore is positioning itself as more friendly to cryptocurrencies than other regions. Statement on Cryptocurrencies and Initial Coin Offerings. Sufficient consultations should come first," Hong Nam-ki, minister of office for government policy coordination, told parliament. Public Statement. Investors trying to get a gauge on the state of U. These are key hallmarks of a security and a securities offering. This should be a clear signal that the sector is booming. We want to hear from you. What is happening? There is no strong case to ban digital currency in the city-state, Singapore's central bank said in February, noting "it is too early to say if they will succeed. Oracle's Larry Ellison got crushed on his Tesla investment this The town of Zug, just south of Zurich, is nicknamed "Crypto Valley" and is home to blockchain companies including the Ethereum Foundation, and cryptocurrency wallet company Cardano. The SEC's Hinman notably stopped short of declaring that the initial investments made in ether weren't securities.

Similarly, I also caution those who operate systems and platforms that effect or facilitate transactions in these products that they may be operating unregistered exchanges or broker-dealers that are in violation of the Securities Exchange Act of But activity in crypto has carried on through alternative channels like mining. Science Expert Explains One Concept in 5 Levels of Difficulty - Blockchain Blockchain, coinbase wallet vs exodus how use bitcoin core key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. Ethereum credit card buy bitcoin price max look at monitors showing the prices of virtual currencies at the Bithumb exchange office in Seoul, South Korea, Feb. This should be a clear signal that the sector is booming. HP, Autodesk, Boeing Inthe government banned ICOs — a way for start-ups to raise funds by selling off new digital currencies — and shut down domestic cryptocurrency exchanges. Have they been paid to promote the product? The PwC report highlighted how the small Swiss municipality has emerged as a "hotbed for blockchain-based companies and advisory services," and the country's growing "reputation of being a welcoming environment for companies and tech firms. Mad Money with Jim Cramer read .

Key Points. Four days ago the crypto markets were crashing hard. Treasury Secretary Steven Mnuchin has been vocal about bitcoin's ability to aid criminals, telling CNBC in Davos in January his main focus on cryptocurrencies is "to make sure that they're not used for illicit activities. Get this delivered to your inbox, and more info about our products and services. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The agency also said cryptocurrencies are not legal tender and highlighted the risk posed by bitcoin's anonymity. Legal, depending on the country. Market Insider read more. Login Advisor Login Newsletters. Although prices have fluctuated wildly—and in some cases enormously to the downside—the sector is finally starting to stabilize and increasingly appears to be leaving its infancy behind. Owners of bitcoin and ether, however, now appear safe from that sort of close scrutiny. Partner Links. Please also see the SEC investor bulletins, alerts and statements referenced in note 3 of this statement. Technology read more.

What is happening? Tokens and offerings that incorporate features and marketing efforts that emphasize the potential for profits based on the entrepreneurial or would someone please explain bitcoin ether vs litecoin efforts of others continue to contain the hallmarks of a security under U. It was the first country to adopt a national system to regulate cryptocurrency trading after its exchanges were subject to some well-known breaches including Mt. Key Points. Mad Money with Jim Cramer read. As a result, risks can be amplified, including the risk that market regulators, such as the SEC, may not be able to effectively pursue bad actors or recover funds. Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways gpu compare mining gpu eth mining entrepreneurs and others to raise funding, including for coinbase paypal fees bitcoin up percent this year projects. Other often-touted features of cryptocurrencies include personal anonymity and the absence of government regulation bank transfer pending in coinbase bittrex reliable oversight. For example, just as with a Regulation D exempt offering to raise capital for the manufacturing of a physical product, an initial coin offering that is a security can be structured so that it qualifies for an applicable exemption from the registration requirements. Trading bitcoin in China is technically illegal. Exchanges are legal if they are registered with the Japanese Financial Services Agency. The technology on which cryptocurrencies and ICOs are based may prove to be disruptive, transformative and efficiency enhancing. Initial Coin Offerings. It's possible that investments made early, before the currency became truly decentralized, could still be viewed as traditional investment vehicles. A similar number, if not more, help to develop Bitcoin. Market Insider read. Good question.

Erik Voorhees, founder of ShapeShift, felt that the inevitable collapse of the global financial system is good for folks with at least a few BTC in their wallets. The Securities and Exchange Commission has indicated it views digital currency as a security. These offerings can take many different forms, and the rights and interests a coin is purported to provide the holder can vary widely. Instead, of primary concern is whether the technology is progressing. Trading in South Korea makes up about 4 percent of daily volume of bitcoin. What legal protections may or may not be available in the event of fraud, a hack, malware, or a downturn in business prospects? The scheme had received endorsements from professional boxer Floyd Mayweather and music producer DJ Khaled. However, this also means that those same companies can be more serious about products and production rather than simply fundraising. There is no strong case to ban digital currency in the city-state, Singapore's central bank said in February, noting "it is too early to say if they will succeed. Science Expert Explains One Concept in 5 Levels of Difficulty - Blockchain Blockchain, the key technology behind Bitcoin, is a new network that helps decentralize trade, and allows for more peer-to-peer transactions. The lack of acceptance, especially in the investment arena can partially be attributed to the U. Data also provided by. The bag holder theory November was supposed to be a good month for crypto. Related Tags. Not legal tender, according to Financial Crimes Enforcement Network. Initial Coin Offerings July 25, , available at https: A change in the structure of a securities offering does not change the fundamental point that when a security is being offered, our securities laws must be followed.

Carney, who is also governor of the Bank of England, pointed to the small size relative of the asset class compared with the entire financial syste. Others, like the Binance CEO Changpeng Zhao , are expecting a bull run next year and said his company was particularly profitable. Additionally, this statement is not a comment on any particular submission, in the form of a proposed rule change or otherwise, pending before the Commission. Dow drops more than points, continuing this month's slide on trade war fears. See which stocks are posting big moves after the bell on Thursday, May I also caution market participants against promoting or touting the offer and sale of coins without first determining whether the securities laws apply to those actions. Justice Department is looking into Bitfinex for manipulating the price of Bitcoin. Sign up for free newsletters and get more CNBC delivered to your inbox.