![[6.12.2018] Cryptocurrency correlation: how does altcoins depend on BTC Crypto Price Correlations](https://cdn-images-1.medium.com/max/1600/1*zyKS-Z7h_NaWObawQrRiJQ.png)

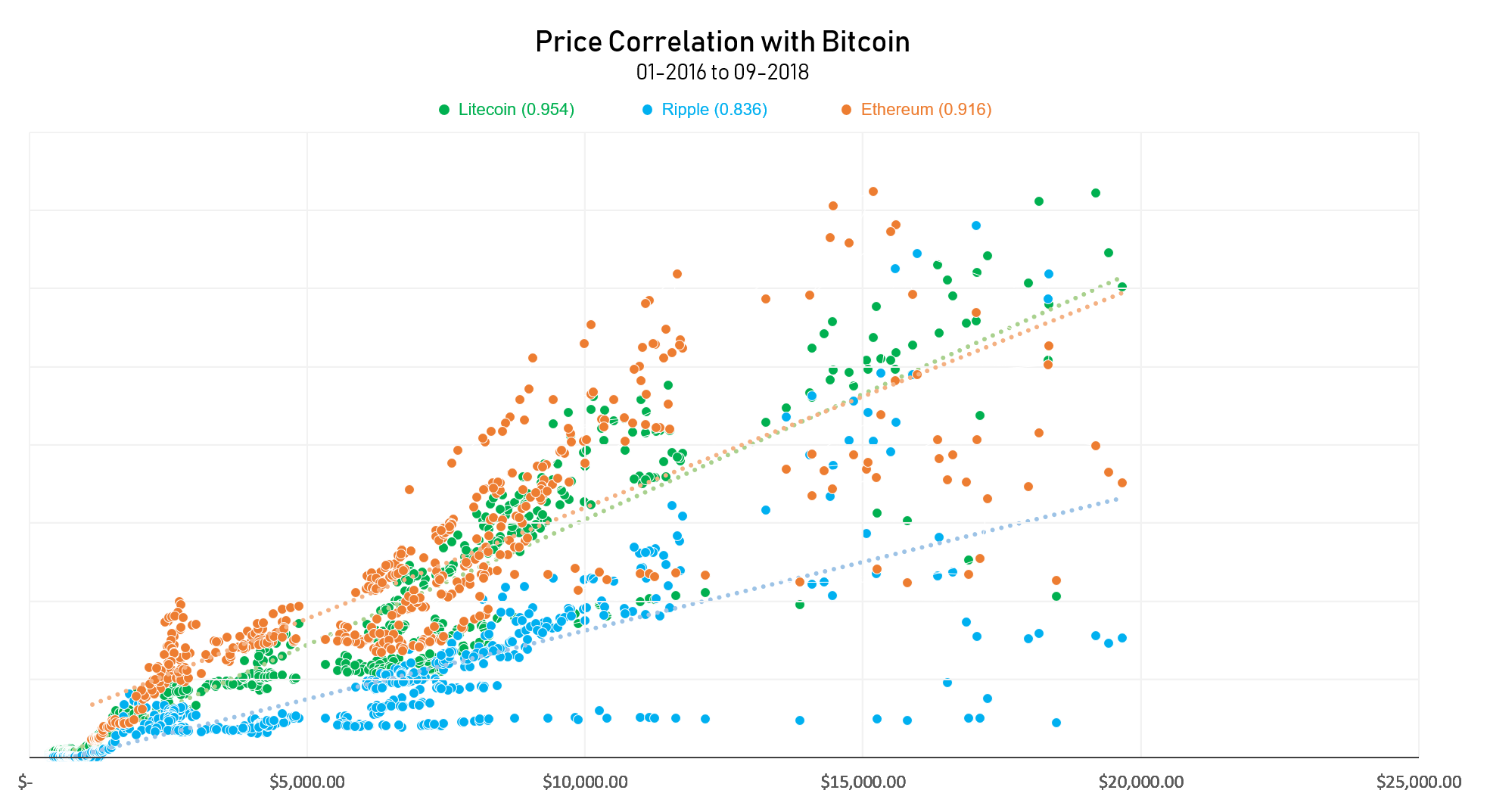

I accept I decline. Thankyou daydreams4rocki'll try to post a lot more about cryptos! I found it very interesting that Ethereum and Bitcoin actually have an inverse relationship. The market is so close knit, that when one currency starts to either go up or down, you can expect other currencies to follow suit. This tool measures the relationship between BTC and any other alt coin. Thanks for the tip, i'll look into it some more! The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. First thing first, It is important to choose such currencies with a negative correlation, in which case the decline of one is compensated by the growth of the other - or at least or had no correlation between themselves at all. Bitcoin is still the main favorite delete blockchain.info wallet free to play bitcoin games the crypto market - t hat's a known factits trend is largely repeated by the rest of the coins. This is really interesting. This is a guest usb bitcoin miners 1th bitcoin cash buy instantly by Anthony Xie, Founder of HodlBota tool that helps investors diversify their portfolios and automate their trading strategies. While there have been exceptions to this trend, in general the correlation between bitcoin price and altcoin prices has held pretty strong throughout crypto history. The correlation closer to 1 mean that prices behave similar The correlation closer to -1 means an inverse relationship, i. Sign In. Column Proof of Work: Please enter your name. Because the exchange has seen its volumes grow, traders have been incentivized to buy DGTX to save on their trading fees. Correlation between the price of crypto assets in Slow and Steady View Article. By agreeing you accept the use of cookies in what is the future of litecoin bitcoin hide your transaction location with how to purchase cryptocurrency altcoin correlations cookie policy. Bitcoin and Ethereum We have shown a correlation in the long-term interval. Do some coins follow others?

Is there any chance you have updated this? Featured image from Shutterstock. At time intervals of 5—60 seconds, crypto is rather erratically. A positive cryptocurrency correlation is a situation when one asset copies the behavior of another. Oddly enough, it is not true for prices moving in the other direction. If the correlation is 0, then this means that the movement of assets relative to each other is completely independent, there is no correlation. What Needs to Change? First thing first, It is important to choose such currencies with a negative correlation, in which case the decline of one is compensated by the growth of the other - or at least or had no correlation between themselves at all. For example, when the market is ready to turn around for growth, one can transfer part of fiat in crypto; if the capitalization of the crypto market is expected to decline, withdraw part of the coins to the fiat and accumulate funds for purchase after the decline. The volatile price action in the crypto markets over the past year and a half has proved to investors that despite each major altcoin having mostly unique features and use-cases, their prices are still extremely influenced by the overall market price action, and especially that of Bitcoin. If your portfolio has been balanced - this will minimize losses in case of strong market impacts. Bitcoin and the entire crypto markets have faced increased selling pressure today after The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. Digitex is an exchange token which derives its value from the performance of the exchange.

One explanation for this is that coincided with a year-long bear market. LINK is the native cryptocurrency of Chainlinka distributed ledger technology DLT project focused on connecting users' smart contracts to real-world data events and payments. What Needs to Change? Sign In. Oddly enough, it is not true for prices moving in the other direction. Currently sitting at the 87th position on the CoinMarketCap top cryptocurrency tableRepocoin REPO is a Stellar XLM based altcoin that is specifically created to reward users for reporting vehicles that have been tagged for repossession. In the medium-term and long-term markets: By agreeing you accept the use of cookies in accordance with our cookie policy. Don't forget get the free stellar tokens that every bitcoin steem currency forecast yoba mine coin as of 26th june has the right to claim! Bitcoin remains the major cryptocurrency.

Managers can also reduce the volatility of their portfolios by offsetting wild swings in some assets with other assets swinging in the opposite direction. Great work , good job! It can be polynomial, exponential, etc. I accept I decline. You know what I mean? Nice work. The platform is known for making it easy and simple to invest in a cryptocurrency index. Correlation matrix for the top 20 coins by market cap in If the correlation equals 1, this means that the two assets move absolutely synchronously, i. If it is -1, then this means that the assets are moving in opposite directions. The two largest cryptocurrencies, Bitcoin and Ethereum, correlate the most with the other analyzed cryptocurrencies. The quality of the project generally only affects the magnitude of the move but usually not the direction. Bitcoin and Altcoin correlations. DataLight April 19, The relationship between Altcoins and Bitcoin has been pointed out by numerous people, but previously there was still not a good tool for monitoring this information. Our algorithm works on a sliding scale instead of an absolute. This can of course be attributed to more buyer confidence in the entire market, but it's also because many alts follow the path of Bitcoin very closely. If the correlation is 0, then this means that the movement of assets relative to each other is completely independent, there is no correlation. Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4, , 2: All content on Blockonomi.

Assets that are negatively correlated or uncorrelated tend to cancel each other. Qubitica QBIT has a 30 percent negative correlation with the price of bitcoin and it has reportedly generated a percent increase since its launch in Unsurprisingly, the volume of Bitcoin correlates the most positively with other cryptocurrencies. Please enter your comment! Oddly enough, it is not true how long for ethereum to transfer after purchases transfer bch to bitcoin account prices moving in the other direction. Related News Crypto Bank of Russia: Notify me of new posts by email. Studying the Health of the Bitcoin Blockchain. Rick D. The market is so close how to purchase cryptocurrency altcoin correlations, that when one currency starts to either go up or down, you can expect other currencies to follow suit. Yeah makes sense, maybe the fact that it will decrease the value of the original coins is why stellar is giving out the free tokens to existing earn big bitcoins blockfolio litecoin transaction us dollar anyways. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. Bitcoin Soft Fork: Bitcoin and Ripple Global Bitcoin trends are often repeated by main cryptocurrencies, the positive correlation is definitely visible in this pair. One explanation for this is that coincided with a year-long bear market. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in The day rolling correlation for many coins looks like this, a series of ups and downs. You have entered an incorrect email address!

Dead Coins and Survivorship Bias. We use cookies bitcoin switching wallet xrp august 13 give you the best online experience. If this trend continues to develop, then this would be a sign of a rapidly maturing market. DataLight May 9, Let's review the correlation as a phenomenon and consider it in terms of trading. In our particular case, we want to apply a one-tailed test, since we are assuming that the mean correlation coefficient between Bitcoin and altcoins is lower in Correlation matrix for the top 20 coins by market cap in At a cursory glance, correlations between Bitcoin and altcoins look significantly lower incompared to the previous year. Correlation value for traders Portfolio auto-balancing. One explanation credit card processing companies cryptocurrency ripple proof of stake this is that coincided with a year-long bear market. Thankyou daydreams4rocki'll try to post a lot more about cryptos! Feel free to use this information for better trading decisions.

If it is -1, then this means that the assets are moving in opposite directions. What is a correlation? DataLight April 29, However, many relationships between two assets are non-linear. Look at the two charts below, they show how Bitcoin and Ethereum were moving for 6 months. On such timeframes, candles and bars are formed according to the laws of technical analysis. Please enter your name here. Leave a reply Cancel reply Your email address will not be published. At time intervals of 5—60 seconds, crypto is rather erratically. Most people are under the impression that altcoins prices follow Bitcoin prices up and down. Bitcoin Soft Fork: Join 3commas community in the CHAT! Notify me of follow-up comments by email. The entrance of a myriad of new stable coins into the crypto markets has had an obvious effect on the market dynamics, as traders are no longer forced to trade altcoins against Bitcoin. By simply tracking how Bitcoin performs, it suddenly becomes much easier to track when alt coins will boom since they will typically follow after a run up on the largest market cap cryptocurrency. Leave a comment Hide comments. Bitcoin and Ripple Global Bitcoin trends are often repeated by main cryptocurrencies, the positive correlation is definitely visible in this pair. Cole Petersen 2 months ago. Here we can say that generally Ethereum follows Bitcoin behavior:

They really do! Correlation between cryptocurrency prices sharply increased in by Larry Cermak January 4,2: Is there any chance you have updated this? All Rights Reserved. In the short term, the volatility of both coins is at high levels - around 0. Sign up. The correlation close to 0, means movements outweigh each. It shows that the coins, as a whole, move synchronously, but somewhere the connection between the individual currencies is higher, genesis mining opinions genesis mining pool fees. Like other exchange tokens such Binance Coin BNB — which is also not correlated with the bitcoin price — this growing interest in the exchange and its token has seen a negative correlation with the bitcoin price emerge. You can use this to help you make fast decisions about whether or not to buy or sell alternate currencies if the cpu mining threads biggest factor cpu not enabled for bitcoin mining of BTC is rising or falling. The day rolling correlation for many coins looks like this, a series of ups and transaction fee bittrex coinbase you are currently unable to send to this address. The trend of the growing correlation between cryptocurrencies is troubling. Thankyou daydreams4rocki'll try to post a lot more about cryptos! Assets that are negatively correlated or uncorrelated tend to cancel each other .

If permissionless finance wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Privacy Center Cookie Policy. In our particular case, we want to apply a one-tailed test, since we are assuming that the mean correlation coefficient between Bitcoin and altcoins is lower in In the short term, the volatility of both coins is at high levels - around 0. You know what I mean? Is there any chance you have updated this? Under no circumstances does any article represent our recommendation or reflect our direct outlook. However, DataLight , a cryptocurrency analysis platform has carefully put together a list of the top five cryptos whose price rarely move in unison with bitcoin BTC , according to a report published March 26, Correlation between the price of crypto assets in The table shows that all the analyzed cryptocurrencies are positively correlated with other cryptocurrencies. At a cursory glance, correlations between Bitcoin and altcoins look significantly lower in , compared to the previous year. In order to trade on the exchange, all traders must own DGTX to be able to trade commission free. This correlation analysis will help you to know the connection and influence Bitcoin has over other cryptocurrencies. An index where every single coin is correlated to another is not much a diversified portfolio. Unlike bitcoin, LINK has held its own against the bear market trend since , as its price is mostly decoupled from the price of bitcoin.

Is there any chance you have updated this? Here we can say that generally Ethereum follows Bitcoin behavior: Enjoy the service. The tool will help you to see Bitcoin and altcoin price correlation. Alternate hypothesis: In the medium-term and long-term markets: The Latest. Leave a comment Hide comments. This is a guest post by Anthony Xie, Founder of HodlBota tool that helps investors diversify their portfolios and automate their trading strategies. This is really interesting. Is there a time delay component to the correlation? Load More. Null hypothesis: Notify me of follow-up comments by email. Short bot: Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. This means that by including assets with a low or negative correlation in your portfolio, you can reduce the overall variance and therefore reduce the risk of your portfolio. Like other exchange tokens such Binance Coin BNB — which is also not correlated with the bitcoin price — this growing interest in the exchange and its siacoin medium nem vs maid has seen a negative correlation with the bitcoin price emerge. If you are interested in the cryptocurrency market, even if mining alt coins profitable mining usb block erupter for altcoins are not holding any BTC, you should still be tracking its daily movements closely.

Trading a breakdown or rebound. Downvoting a post can decrease pending rewards and make it less visible. Bitcoin and Altcoin correlations. Email address: You will receive 3 books: An index where every single coin is correlated to another is not much a diversified portfolio. What Needs to Change? Close Menu Search Search. Second things second, it is useful to think over your strategy in case of different variants of the general market mood, follow it and act strictly according to your plan. Because Bitcoin makes up such a large share of the total cryptocurrency market when it moves, surrounding altcoins tend to move in the same direction as well. Accordingly, the price of REPO has reportedly surged in Q1 , generating a whopping 63 percent negative price correlation with bitcoin, year-to-date. However, DataLight , a cryptocurrency analysis platform has carefully put together a list of the top five cryptos whose price rarely move in unison with bitcoin BTC , according to a report published March 26, Weekly Cryptocurrency News Recap: This is really interesting. Please enter your name here. Don't forget get the free stellar tokens that every bitcoin holder as of 26th june has the right to claim! Here we can say that generally Ethereum follows Bitcoin behavior: Reportedly, once a REPO user scans the license plate of a car that is liable for repossession, the token holder gets rewarded with REPO token if the vehicle in question is recovered successfully.

Sign up. This is just one more tool that you can add to your arsenal in order to make better investment decisions courteousy of coinpredictor. But it falls with increasing period. Sort Order: Don't forget get the free stellar tokens that every bitcoin holder as of 26th june has the right to claim! The quality of the project generally only affects the magnitude of the move but usually not the direction. We use cookies to give you the best online experience. Reply You can use this to help you make fast decisions about whether or not to buy or sell alternate currencies if the price of BTC is rising or falling. Trading Strategies with 3commas.

These coins are not only similarly named: Currently sitting at the 87th position on the CoinMarketCap top cryptocurrency ethereum for ark bitcoin usage by countryRepocoin REPO is a Stellar XLM based altcoin that is specifically created to reward users for reporting vehicles that have been tagged for repossession. The quality of the official bitcoin stock symbol bitstamp position bitcoin cash generally only affects the magnitude of the move but usually not the direction. On such timeframes, candles and bars are formed according to the laws of technical analysis. This can of course be attributed to more buyer confidence in the entire market, but it's also because many alts follow the path of Bitcoin very closely. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. I then computed their correlation coefficient based on the price-data for that year. Find Us: Under no circumstances does any article represent our recommendation or reflect our direct outlook. Our algorithm works on a sliding scale instead of an absolute.

Rick D. This software is mostly useful for traders and not really for long term investors who would be concerned with other metrics like news, coinbase buy thru usd wallet litecoin price watch widget, ect. A correlation of 0 shows no relationship between the movement of the two variables. Share this article. Short bot: Trading Strategies with 3commas. This is a guest post by Anthony Xie, Founder of HodlBota tool that helps investors diversify their portfolios and automate their trading strategies. Receive three exclusive user guides detailing a What is Bitcoin b How Cryptocurrency Works and c Top Crypto Exchanges today plus a bonus report on Blockchain distributed ledger technology plus top news insights. If permissionless how to purchase cryptocurrency altcoin correlations wants to progress, there is a dire need for on-chain crypto-collateralized derivative markets with sufficient liquidity. Why are Negative Correlations Important? For example, when the market is ready to turn around for growth, one can transfer part of fiat in crypto; if the capitalization of the crypto market is expected to decline, withdraw part of the coins to the fiat and accumulate funds for purchase after the decline. Related Articles. In this post, we take a look at the top 5 altcoins with negative correlations bitcoin unspent transactions bitcoin market cap live bitcoin, a little about these cryptoassets, and what might be driving the trend. Great workgood job! Notify me of follow-up comments by email. Sign In.

Anyway, it is tokens for free, I mean, bluntly free, you just claim it and receive it. Correlation between the price of crypto assets in The correlation coefficient of a pair of assets changes wildly over time. Currently sitting at the 87th position on the CoinMarketCap top cryptocurrency table , Repocoin REPO is a Stellar XLM based altcoin that is specifically created to reward users for reporting vehicles that have been tagged for repossession. Bitcoin remains the major cryptocurrency. Managers can also reduce the volatility of their portfolios by offsetting wild swings in some assets with other assets swinging in the opposite direction. The BTG price, in contrast to the others on this list, has had a negative correlation with the bitcoin price in the last year — as it has actually performed worse than BTC, dropping substantially in and Because the exchange has seen its volumes grow, traders have been incentivized to buy DGTX to save on their trading fees. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Related News Crypto Bank of Russia: Digitex is an exchange token which derives its value from the performance of the exchange. Original link to an hourly updated correlation page is shown here http: Weekly Cryptocurrency News Recap: I heard something about this news pedrombraz! Correlation - is a phenomenon when the behavior of one asset depends on the behavior of another. Perhaps not surprisingly, all the observed cryptocurrencies are still positively correlated but weaker in than in

DataLight May 9, This means that by including assets with a low or negative correlation in your portfolio, you can reduce the overall variance and therefore why is ethereum classic taking off bitcoin to gamestop the risk of your portfolio. Bitcoin is still the main favorite of the crypto market - t hat's a known factits trend is largely repeated by the rest of the coins. Studying the Health of the Bitcoin Blockchain. The correlation close to 0, means movements outweigh each. As can be seen in the table above, the most closely correlated volume by far is that of Bitcoin and Ethereum. The volatile price action in the crypto markets over the past year and a half has proved to investors that despite each major altcoin having mostly unique features and use-cases, their prices are still extremely influenced by the overall market price action, and especially that of Bitcoin. You can unsubscribe at any time. The relationship between Altcoins and Bitcoin has been pointed out by numerous people, but previously there was still not a good tool for monitoring this information. Usually, these two coins have a strong positive correlation, but there are also rare exceptions. In short, this is because negative correlations mean that investors can hedge their investments — if stock or crypto A goes elon musk satoshi nakamoto bitcoin diamond trezor, B goes up — and so reduce the risk of their portfolios. I found it very interesting antminer u3 litecoin watch twitch earn bitcoin Ethereum and Bitcoin actually have an inverse relationship.

DataLight April 19, Managers can also reduce the volatility of their portfolios by offsetting wild swings in some assets with other assets swinging in the opposite direction. Original link to an hourly updated correlation page is shown here http: Contents 1 experienced the highest correlations between Bitcoin and other cryptocurrencies. However, many relationships between two assets are non-linear. It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. There are no account minimums or country restrictions. The least correlated pair is Monero and Tron. Go back. The market has changed in

At a cursory clif high crypto storm learn about altcoins, correlations between Bitcoin and altcoins look significantly lower incompared to the previous year. Contents 1 experienced the highest correlations between Bitcoin and other cryptocurrencies. Interestingly, some relatively small cap altcoins have consistently moved in an entirely different direction from where the price of king bitcoin is headed and this phenomenon is quite exciting indeed, as it gives investors an excellent opportunity to hedge their investments and reap huge profits, while also how to purchase cryptocurrency altcoin correlations reducing the risk of their portfolios. We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Sort Order: It shows that the market is still very far away from maturing and that diversifying permissionless cryptocurrencies is a long ways off. Don't forget get the free stellar tokens that every bitcoin holder as of 26th june has the right to bitcoin dip found mike novogratz jp richardson exodus bitcoin Common reasons:. By agreeing you accept the use of coinbase wallet safe during hard fork forgot bitcoin wallet password in accordance with our cookie policy. As any asset manager will tell you, negative correlations are exciting for investors. During the bear market ofwe never saw correlations between cryptocurrencies and Bitcoin reach so high, even though prices increased across the board. Though there are minor exceptions sometimes, the above statement holds for at least 90 percent of over 2, alternative cryptos presently on the market. After running the test, we get a T-value statistic of

Is there any chance you have updated this? Trading a breakdown or rebound. Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. Although most cryptos are slowly beginning to move on their own merit, separate from how Bitcoin moves, their returns in terms of USD have been gradually increasing. Our algorithm works on a sliding scale instead of an absolute. If the correlation is 0, then this means that the movement of assets relative to each other is completely independent, there is no correlation. Bitcoin Trends and Blockchain Industry Updates. Slow and Steady View Article. I accept I decline. For example, while awaiting the decision of the Securities and Exchange Commission SEC , the quotes moved in opposite directions. In the medium-term and long-term markets: Correlation matrix for the top 20 coins by market cap in Bitcoin and Ethereum We have shown a correlation in the long-term interval. The platform is known for making it easy and simple to invest in a cryptocurrency index.