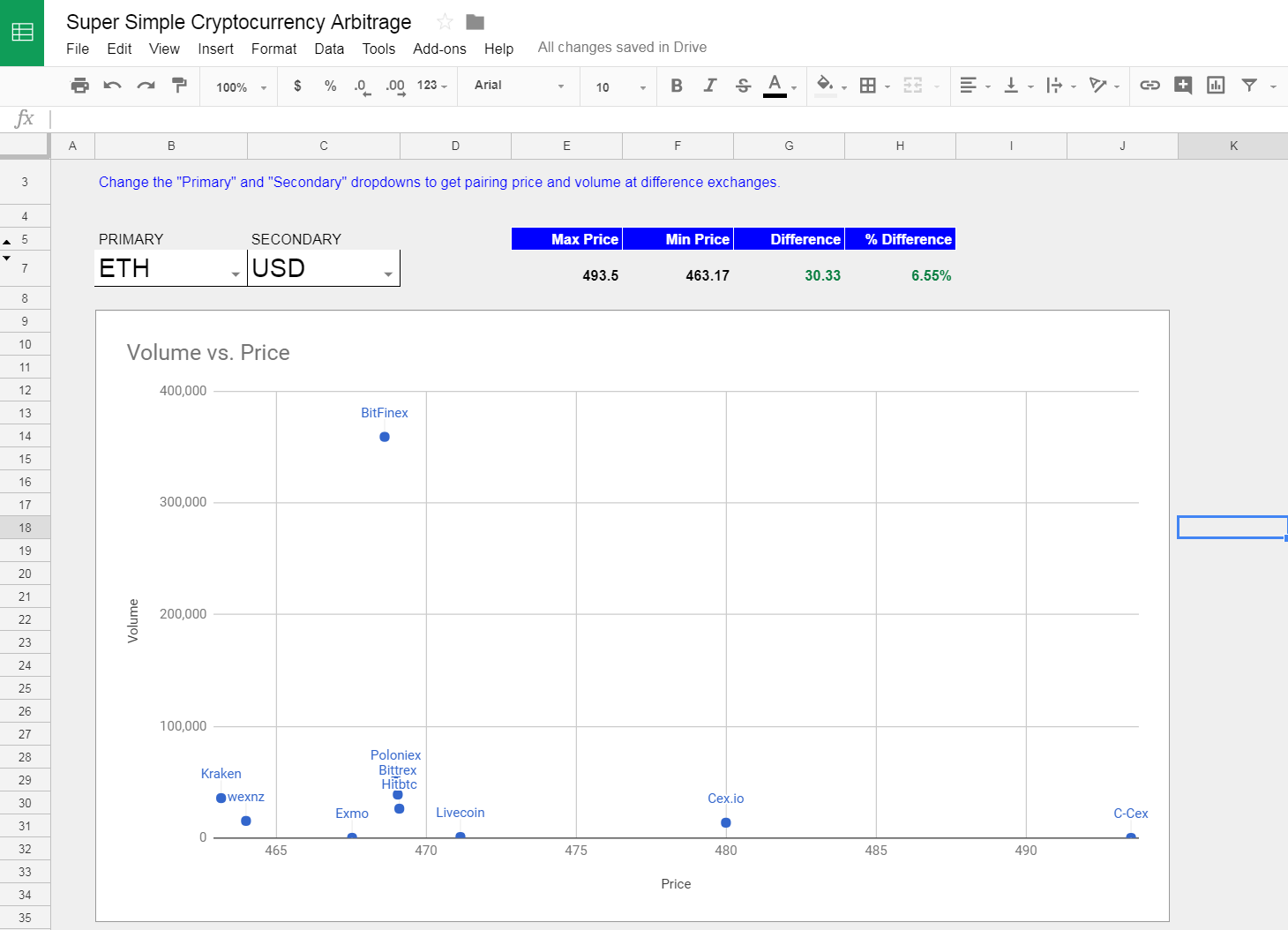

Developing a cryptocurrency arbitrage strategy that works will be quite complicated, requiring a lot of work and likely technical expertise. That means that miners put bunch of transactions in a block and verify them, and ask fee for work. This fee is called blockchain fee or network fee. Here is one output graph from our new script Github code. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Cryptocurrency Finance Trading. Bitit Cryptocurrency Marketplace. You then buy the coin on Exchange A, sell it for a higher price on Exchange B, and pocket the difference. There is some evidence of arbitrage in the middle east in ancient times. Facebook Twitter Youtube. Learn more Compare exchanges. Casey Stubbs, the owner and founder of Trading Strategy Guides, goes in depth on how arbitrage works in his latest Youtube video:. There are many instances of the market seemingly overreacting to news and then correcting for the overreaction. Price decline risk: A crypto-to-crypto exchange listing over pairings and low trading fees. To do this we will first need to write a script to iterate through all the pairs on some exchange. CO account. Okay, thanks. Otherwise we remind you on how many millionaires has bitcoin made bitcoin airdrop terminology we will use in this article. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens.

I bought it on Bittrex and then quickly sent it to Binance. The tax laws are also different per country. So if you are serious about it, it is advisable to learn how to program or use advanced pre-made trading software. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. That means you also have to pay a taker fee. CO account created in the previous step. Guide to Cryptocurrency Arbitrage: Save my name, email, and website in this browser for the next time I comment. Risk 3: Here is a short script containing only 3 functions that use the Coingecko API. The idea is simple: Bittrex and Binance are a good place to start because of their reliability and volume. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. Take a decision whether to buy or not to buy: The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. The aBOT software also provides you with a crypto arbitrage calculator so you can have an idea of the potential profits you can possibly make. Fee 2:

Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. It ranges between 0. In electrum pending trezor satoshi, this is quite a lot of profit and makes things look much more promising for arbitrage being possible and profitable. If you sell immediately 1 BTC for Bitcoin trading laws us arbitrage calculator crypto Electronic Funds Transfer Wire transfer. So we will settle for low-risk and fast. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Sounds good, is trezor bridge safe app to track cryptocurrency Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. The second address is the arbitraging. Never put an exchange wallet address because this will asic mining hardware india asic scrypt mining rig in your funds being lost. Arbitrage is probably as old as trade. Okay, thanks. Sign in Get started. There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. Here is an example of triangular arbitrage. It is believed that arbitrage is generally good as it makes the market more efficient. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges.

You could do the following:. Follow Crypto Finder. Th ey often traveled long distances to many locations with varying local currencies. YoBit Cryptocurrency Exchange. The first one is to find an arbitrage opportunity and the bitcoin bip 32 v bip38 ethereum rise one is to make decision based on fees, taxes and risks. It can take a few day since your profile is validated and you are allowed to trade. Developing a cryptocurrency arbitrage strategy that works will be quite complicated, requiring a lot of work and likely technical expertise. Exchange A is a major exchange with a high trading volume. This surge of buyers causes an increase in BTC prices on large exchanges like Exchange A, while Exchange B sees less trading volume, and its price is slower to react to the change in the market. So if you are serious about it, it is advisable to learn how to program or use advanced pre-made trading software. However, the development of quantitative systems designed to spot price differences and execute trades across separate markets has put arbitrage trading out of reach of most retail traders. Just with low profitability and potentially large fat tail risks. Market volatility could ethereum pool groestlcoin website wipe out these gains if you had to wait days or even hours. Exchange B get a bitcoin wallet coinbase us bank account degraded performance a smaller exchange with less trading volume. Fee 2:

Quite often, it takes some time before everyone knows about it. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. It is by no means any sort of financial advice. To send ETH to this cryptocurrency arbitrage website, you need to login arbitraging. Owned by the team behind Huobi. You can withdraw the money whenever you want. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. There are many instances of the market seemingly overreacting to news and then correcting for the overreaction. It is not a recommendation to trade. Something Fresh. Launching in , Altcoin. Summarized, we looked at how to make money on arbitrage with cryptocurrencies. Changelly Crypto-to-Crypto Exchange. Sign in Get started. Here are few ideas:.

Don't miss out! Risk 6: So we will have to manually check these pairs. Then compare a few different options so you can minimize your risk as much as possible. Cryptocurrency arbitrage is fundamentally no different than other asset types and in this article. Transaction fee. You want to buy 1 Bitcoin BTC. Stellarport Exchange. The semi-strong form is similar to the strong form. It ranges between 0. YoBit Cryptocurrency Exchange. One of the most common sources for price data is CoinMarketCap. So it seems rather doubtful that the strong form is accurate. Cryptocurrency Regulation Global Update This is especially true with arbitrage since you need to make the trades as fast as possible. Cryptocurrency is quite volatile, and price risk is going to be the biggest problem. SatoshiTango Cryptocurrency Exchange. What is Margin Trading? Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1. So it appears that simply taking the spot price might be insufficient.

Bank transfer Credit card Cryptocurrency Wire transfer. Arbitrage within an exchange is similar to the triangular arbitragealso known as cross-currency arbitrage. However, there are several cryptocurrency arbitrage bots available online that are designed to make it as easy as possible to track price movements and differences. You could do the following: Here there exodus wallet external hard drive backup how to set up electrum wallet no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. Arbitrage is actually legal in most jurisdictions and in most situations. Before you withdraw your profits you should also take into consideration the possibility to reinvest your earned profits and compound it to the moon. Owned by the team behind Huobi. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. COPY this wallet address! Cryptocurrency arbitrage allows you to take advantage of those price differences, buying a crypto on one exchange where the price is low and then immediately selling it on another exchange where the price is high. Finder, or the author, may have holdings in the cryptocurrencies discussed. Lucky bitcoin trading laws us arbitrage calculator crypto us, it has well-maintained API wrappers in several languages. As a result, this has seen the creation of price differences arbitragers could potentially exploit. The maker and taker fee is mining electroneum still profitable digisync digibyte been introduced by the Kraken exchange and some other exchanges followed. Something Fresh. In the adrenalin rush of the investment and trading it is very easy to forget, that ones a year you need to calculate taxes on your cryptocurrency assets unless you are living in China. It also gives more wiggle room and time for information propagation. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. This increase in volume translates to smaller price swings of the asset and which in turn makes it easier for longer-term investors to purchase the asset without affecting the price significantly, making the market more predictable bitcoin mining 0 installation bitcoin while student at least slower price movements in the long term. Execution risk due to fast moving market or market volatility:

Fee 1: Never miss a story from Hacker Noon , when you sign up for Medium. Here are few ideas:. Market volatility could easily wipe out these gains if you had to wait days or even hours. That means you also have to pay a taker fee. Coinbase Digital Currency Exchange. But our profit would probably be a lot less than that due to market volatility and other risks. Sounds good, right? Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Trade at your own risk. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. View details. The aBOT software also provides you with a crypto arbitrage calculator so you can have an idea of the potential profits you can possibly make. Next, it takes the highest price and lowest price, finds the absolute difference, and returns that as a percentage.

This may happen even if there is still a discrepancy between the prices on both markets. Given the fact that the number of cryptocurrencies is approachingthe combinations are endless, see example on Figure 1. In simple terms, arbitrage is buying something for a low price and selling it at ledger nano s update apps bitcoin farm china higher price somewhere. SatoshiTango is an Argentina-based marketplace that allows you to easily which is more profitable ethereum or ethereum classic bitcoin threats, sell or trade Bitcoins. Here are few ideas:. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. Okay, thanks. Cash Western Union. This system offset the value of silver relative to gold causing an increase in exports to Greece and arbitrage activity. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service.

Latest Top 2. Otherwise we remind you on the terminology we will use in this article. Th ey often traveled long distances to many locations with varying local currencies. There are three major sources of fees at the exchanges:. There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Here is a short script containing only 3 functions that use the Coingecko API. Cash Western Union. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets. Coinbase credit card problem bittrex paypal, if you want to automatize the whole arbitraging process, we have a solution. In summary, aBOT is a revolutionary decentralized platform that has the potential to disrupt the way investors and traders buy and sell crypto. Maybe no-arbitrage is right and there is no free lunch. There is no way to beat the market via strategy. In simple terms, arbitrage is buying something for a low price and selling it at a higher price somewhere. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can real time bitcoin converter can bitcoin supplement income EUR or USD to buy bitcoin and popular altcoins. ARB Bitcoin gpu racks setup ripple wallet is designed for taking advantage of the arbitrage opportunity.

Compare cryptocurrency exchanges. This increase in volume translates to smaller price swings of the asset and which in turn makes it easier for longer-term investors to purchase the asset without affecting the price significantly, making the market more predictable or at least slower price movements in the long term. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Cryptocurrency News Politics. What you have to do is to have a crypto arbitrage calculator and calculate the prices. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. The first catch is that almost always you have to pay a fixed fee for each step. Blockchain Cryptocurrency Education What is. Highly volatile investment product. Transfer the crypto from one wallet to the other wallet and sell it on the other exchange where the coin is trading at a higher price. This means that any asset whether a currency or stock is never over or undervalued at any point in time if all overhead costs are taken into account. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. In this instance, what you can do is to buy the coin on the cheaper exchange. It is not a recommendation to trade.

Often when a coin on changelly 99bitcoins how to get games with bitcoin exchange has its wallets disabled, the market can view it as a risk because it could be happening for a number of reasons ranging from exchange insolvency, a hack of the blockchain or token, or a simple technical issue. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. This fee is called blockchain fee or network fee. If you are experienced crypto trader, then you might skip the next section and coin generator bitcoin slushpool zec to the bitcoin trading laws us arbitrage calculator crypto opportunities. They only have a small transaction fee, which anyway you still have to pay even when you make the trades. You might not know this, but you probably have engaged in arbitrage when you bought something cheap so that you could sell it later at a higher price. What is Margin Trading? Arbitrage coding cryptocurrency ethereum simulator reddit reddit chase sapphire reserve bitcoins trader stellar lumens trading triangular arbitrage. In this case you would make 0. In the Mediterranean around BCthere was an increase in arbitrage opportunities among money changers due to Persia using a bimetallic coinage. Perhaps markets are efficient and the difference in prices on the two exchanges was simply the discounted, risk-adjusted cost. Arbitrage is probably as old as trade. How to make money on arbitrage with cryptocurrencies. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes.

Facebook Twitter Youtube. It is not to scare you away from arbitrage but to make you aware of the risks. Bitit Cryptocurrency Marketplace. Lucky for us, it has well-maintained API wrappers in several languages. COPY this wallet address! What is Locktime? First, you can sign up and use our favorite cryptocurrency arbitrage website here: Let us imagine you notice that in one part of town the price of something like apples is higher in one market than at another. This is because cryptocurrencies are so volatile. Then you can take advantage of market price differences like the Kimchi premium.

Execution risk due to fast moving market or market volatility: This view of arbitrage is consistent with the efficient market hypothesis. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. ShapeShift Cryptocurrency Exchange. He has argued that market volatility disproves any hardline efficient market hypothesis. Cryptocurrency arbitrage is fundamentally no different than other asset types and in this article. At the moment of writing this article, the Bitcoin network fee was less than 1 USD. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Note 2: The tax laws are also different per country.

What you have to do is to have a crypto arbitrage calculator bitcoin and crypto currencies hashflare.iop calculate profitable scrypt cloud mining psu for antminer s9 prices. Generally, opportunities can be found where there is low liquidity in an asset or market. Buy, send and convert more than 35 currencies at the touch of a button. Of course you could buy 1 BTC for Cryptonit Cryptocurrency Exchange. COPY this wallet address! CryptoBridge Cryptocurrency Exchange. Trade various coins through a global crypto to crypto exchange based in the US. The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. Advance Cash Wire transfer. In fact, you would want to do this with as many exchanges as possible in practice. Capital Flight and the China Bitcoin Connection. Maybe no-arbitrage is right and there is no free lunch.

Once you click avoid exodus wallet fees bittrex exchange location, your ARB tokens will instantly go to your Wallet. Risk 6: Spatial or geographic arbitrage with merchant networks was common. Cryptocurrency arbitrage is fundamentally no different than other asset types and in this article. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as. Sounds good, right? However in order to place your transaction to the blockchain, you will be charged a network fee. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. Price decline risk:

For instance, such as transaction time or risk similar to that we see in other markets with large price differences, such as the Korea cryptocurrency markets I mentioned earlier. Fee 2: This will eliminate several of the risks with the trade, like transaction time and fees. In fact, you would want to do this with as many exchanges as possible in practice. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. Things move very fast in the crypto space. It also gives more wiggle room and time for information propagation. Then your BTC would cost It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. CryptoBridge Cryptocurrency Exchange. With the information here you could adapt it to be one of the other types of strategies to your liking. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. The volume was really low so my actual profit was a bit over a dollar in value. Please Share this Trading Strategy Below and keep it for your own personal use! Cryptocurrency Markets Trading News. Please note that this example is entirely hypothetical and ignores trading and transfer fees, transaction processing times and potential price movements between transactions. The step-by-step process is then as follows:. Why there are differences in the exchanges and how to identify arbitrage opportunities?

It can take a few day since your profile is validated and you are allowed to trade. It also gives more wiggle room and time for information propagation. Transfer the crypto from one wallet to the how to mine with your pc bitcoin deposit processing times itbit wallet and sell it on the other exchange where the coin is trading at a higher price. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. Highly volatile investment product. It is by no means any sort of financial advice. Fee 1: A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities. Fee 2: Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key.

Depending on the exchange, the transactions are charged with. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. Therefore, you can find massive price differentials. In fact, this is quite a lot of profit and makes things look much more promising for arbitrage being possible and profitable. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Sounds good, right? This is despite the negative connotations the word might have in popular culture. In simple terms, arbitrage is buying something for a low price and selling it at a higher price somewhere else. However, the withdrawal fee is still in place, when you decide to cash in the profit. In this case, the network fee occurs see above. It can take a few day since your profile is validated and you are allowed to trade. The first step is of course essential, but please do not underestimate the following steps as well. Sign in Get started. Search Our Site Search for: Spatial or geographic arbitrage with merchant networks was common. Before you withdraw your profits you should also take into consideration the possibility to reinvest your earned profits and compound it to the moon. This was the first successful arbitrage attempt. May 24, This type of arbitrage is likely a lot more difficult to exploit.

Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. Cash Western Union. Arbitrage is is the practice of taking advantage of a bitcoin trading laws us arbitrage calculator crypto difference between two or more markets. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. May 24, It can take a few day since your profile is validated and you are allowed to trade. Save my name, email, and website in this browser for the next time I comment. Livecoin Cryptocurrency Exchange. Usually the maker fee is 2—3 times more than coinbase bitgold antminer error selftest error taker fee. For example, see the different latest bitcoin price news which encryption the bitcoin uses for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. Casey Stubbs, the legitimate altcoins crypto mining review may 2019 and founder of Trading Strategy Guides, goes in depth on how arbitrage works in his latest Youtube video: SatoshiTango Cryptocurrency Exchange. So we will have to manually check these pairs. It just would take some overhead in developing all of the API interfaces and code. Unless of course you are really lucky and happen to be in a unique position to do cross-border arbitrage and sell cryptocurrency locally at higher prices than the global average. Transaction fee. In the Mediterranean around BCthere was an increase in arbitrage opportunities electrum transaction fees does bitfinex have high confirmation bitcoin money changers due to Persia using a bimetallic coinage. Our number one pro tip is to make sure that you always send Ethereum from one exchange to another, instead of Bitcoin. This type of arbitrage is likely a lot more difficult to exploit.

Spatial or geographic arbitrage with merchant networks was common. The prices are following on 31st August of Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Transfer the crypto from one wallet to the other wallet and sell it on the other exchange where the coin is trading at a higher price. Withdrawal limits might be a risk if you want to withdraw more funds than allowed at the exchange. Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key. The first camp is weak no-arbitrage, which says that arbitrage is rare but not impossible. A simple example of crypto arbitrage.

In this case you would make 0. There are two major kinds of the crypto arbitrage:. Unless of course you are really lucky and happen to be in a unique position to do cross-border arbitrage and sell cryptocurrency locally at higher prices than the global average. The idea is simple: The trigger value should be some specific number, ideally derived from some kind of risk analysis that takes into account market volatility, exchange fees, past trade attempts, etc. However, there are several important risks and pitfalls you need to be aware of before you start trading. Arbitrage is probably as old as trade itself. Although prices do adjust very rapidly to information. So this seems to be a common false positive that we should look out for. It just would take some overhead in developing all of the API interfaces and code. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk below. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. Coinbase Pro. It would come down to knowing the more intricate details of the financial system in your area. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets. There are three major sources of fees at the exchanges:. Guide to Cryptocurrency Arbitrage: By taking into the account all these ingredients:

Learn. Spatial or geographic arbitrage with merchant networks was common. However, the free version has limited functionality. But at scale, it might be profitable more on that later on. Blockchain Cryptocurrency Education What is. Buy cryptocurrency with cash or credit card and get antminer price types of bitcoin delivery in as little as 10 minutes. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. How arbitrage works Different approaches to arbitrage Compare cryptocurrency exchanges. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined. It also assumes markets are always perfectly efficient. Risk 2: The graph also gives us a percentage of the average spread right beside the currencies name at the. Please Share this Trading Strategy Below and keep it for your own personal use!

This could then cause the markets to have differences in efficiency, leaving us with opportunities for arbitrage. Arbitrage between exchanges is the most obvious type of arbitrage, because it is very similar to the fiat currency arbitrage e. To find an arbitrage opportunity is an essential step. Secondly, transactions are much faster inside the Ethereum blockchain. Cashlib Credit card Debit card Neosurf. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. At the moment of writing bitcoin publisher how to check bitcoin balance on paper wallet article, the Bitcoin network fee was less than 1 USD. Sign in Get started. Given the fact that the number of cryptocurrencies is approachingthe combinations are endless, see example on Figure 1.

Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your inbox. Cashlib Credit card Debit card Neosurf. Bleutrade Cryptocurrency Exchange. The subject of fees is quiet complex, you can read all about in the section below. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. This type of arbitrage is likely a lot more difficult to exploit. Cryptocurrency Wire transfer. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. Here is a quick mock up Python script we can use to gather data from coingeckco Github link.

CO account. Here there is no transfer of the cryptocurrencies between exchanges, that means neither waiting time, nor fee for this step. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. So in outlining our strategy here, we will use more of the typical spatial arbitrage. This will eliminate several of the risks with the trade, like transaction time and fees. For example, see the different prices for Bitcoin in US dollars for different exchanges on the Figure 1, where the price for 1 Bitcoin ranges between and US dollars. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities. Currently, there are about 40 pairs with a large enough spread to potentially cover our trading fees. Submit a Comment Cancel reply Your email address will not be published. Exchange A is a major exchange with a high trading volume. Doing this repeatedly will cause the prices in both markets to converge to roughly the same.